Unlocking value: Yangzijiang Shipbuilding (YZJ) & Yangzijiang Financial Holding (YFH)

2 March 2022

(Please refer to the previous write-up on YZJ for background information.)

The Proposed Spin-off

YZJ has announced its plan to spin-off YFH (previously known as the debt investment division) as separate listed entity on SGX and the shares in YFH will be distributed to shareholders via a dividend-in-specie on a one-to-one basis. The management has arrived at this decision after getting feedback from minority shareholders that some are interested only in its world class shipbuilding business.

Based on 2021 financial report, the net asset value YFH is estimated to be around RMB19bn to RMB20bn. This translates into roughly SGD1.05 per share. (Furthermore, YZJ has declared a SGD0.05 per share dividend to be paid out in May.)

Taking the current share price of SGD1.50, deducts the SGD1.10 above, the remaining world class shipbuilding business is currently valued at SGD0.40 per share. Net cash per share post spin-off should be around SGD0.30-SGD0.35. Given the fully loaded order book of USD8.5bn, we estimate its earnings per share to range between SGD0.12 - SGD0.16 p.a. for the coming 3 years with a dividend per share of at least SGD0.05. It means the P/E for YZJ post spin-off would be around 3x, which is a huge discount whether looking at it on a relative or absolute basis.

The management has also made it clear that they do not intend to hoard excessive amount of cash going forward and YZJ Shipbuilding would stop deploying capital into financial investment. It is natural that YZJ dividend payout will be raised overtime. (We are hopeful that the management would eventually come up with a clear guideline on the amount cash that it will hold and distributes anything over and above that to shareholders, just like what Vtech has been doing all along, in that case everyone will know exactly what to expect.)

The average ROE of YZJ post spin-off is likely to be around 15% p.a., it is quite a feat given that most of its competitors are not making money. (In fact, YZJ ROE will be much higher at over 20% p.a. if not for the large amount of cash sitting on balance sheet).

Yangzijiang Financial Holding

It is very interesting that this massive value being unlocked is coming from the debt investment management division (YFH) which some shareholders didn’t like from the beginning (and hence YZJ shares had been heavily discounted). The fact is that YFH has been and will continue to be a highly successful business in its own right.

In the previous article, we wrote:

"Yangzijiang has been deploying excess cash into secured debt investment since 2008. Essentially, it is giving out short term loan to medium size corporates in China fully backed by collaterals. It is professionally managed by a team of 40 ex-bankers and lawyers. Actually, this type of business is quite common in China because it is not easy for private businesses to borrow from state-owned banks quickly. In Singapore, there is another listed company called First Sponsor Group (FSG) Limited (controlled by Hong Leong Group) also engaged in similar business for over a decade. Most of FSG loan book is back by land and property in China and has also been performing well."

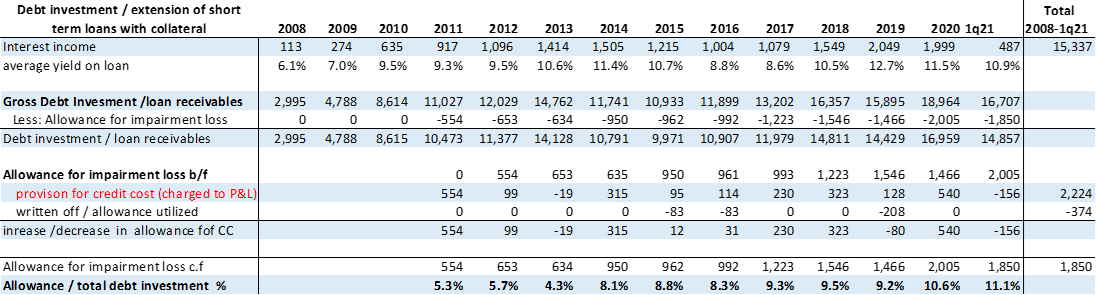

The average yield on loans is around 10%. The default rate is less than 5% and the recovery ratio is more than 80%. This translates into a net credit cost of less than 1% per annum.

Since 2008, the business has generated RMB16.5bn of interest income with a total provision of RMB2.3bn. We estimate the cumulative after-tax net income to be RMB10.7bn over the same period. The long-term average ROA/ROE is between 7% to 8% per annum. The business is fully self-funded, all the RMB16.6bn outstanding as at end-2021 is the company’s own cash. It has proven to be a very solid and fully secured business over many cycles. However, as we previously mentioned, it still doesn’t make sense to run a finance business with zero leverage and generate low ROE.

The new YFH has come up with a comprehensive strategy to transform itself into a full fledge multi-strategy fund management company. On the back of:

Proven track record in investment management since 2008;

Strong network and business relationship (which helps a lot in future funds raising);

Under the direct leadership of honorable chairman Ren Yuanlin (whom is a very shrewd investor in his own right);

Riding the trend of mainland Chinese setting up family office in Singapore;

And couple with the use of some gearing, YFH is likely to continue growing and enhances its average ROE to double digits in the future and paying dividend as well.

Summary

This previously unloved business segment is now going to be spun-off and unlocks a massive SGD1.05 per share of value for shareholders. This is also a manifestation of the strong corporate governance and minority-oriented management of YZJ. The spin-off is truly a win-win solution for all stakeholders.

Overall, we believe that the company is clearly mispriced and is akin to an arbitrage situation at the moment.

Notes and Disclaimers

This essay and the information contained herein is not a specific offer of products or services. Information on this essay is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

Oaklands Path may be long or short the securities mentioned herein and has no duty or obligation to disclose or update our action on these securities.

This essay contains information and views as of the date indicated and such information and views are subject to change without notice. We have no duty or obligation to update the information contained herein. Further, we make no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. Moreover, independent third-party sources cited in these materials are not making any representations or warranties regarding any information attributed to them and shall have no liability in connection with the use of such information in these materials.