The best petrol station chain in Philippines - Pilipinas Shell Petroleum Corporation

13 September 2021

Brief History of P.Shell

P.Shell involves in the marketing & retailing of petroleum products in Philippines since 1914. It currently operates 1,155 petrol stations in the country with majority of these stations in Luzon Island. It also supplies to commercial, industrial as well as airlines via its wide supply chain network.

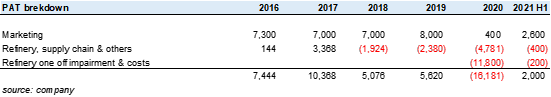

It operated a refinery between 1962 and Aug 2020. Up until the closure of the refinery, the superior business economics of its marketing division had often been dragged down by the capital intensive and challenging refinery business. Its share price peaked at PHP80 with the peaking of refinery upcycle in 2017.

The closure of the refinery allows the company to reduce PHP1bn of annual OPEX and PHP1bn of annual maintenance CAPEX. More importantly, it would allow the excellent business economics of its marketing side to be fully reflected in the company financials. It managed to earn a core PAT of PHP2bn in 1H2021 despite Covid-19 related lockdown reduced demand by 25% as compared to pre-covid time in 1H2019.

The best petrol station chain in Philippines

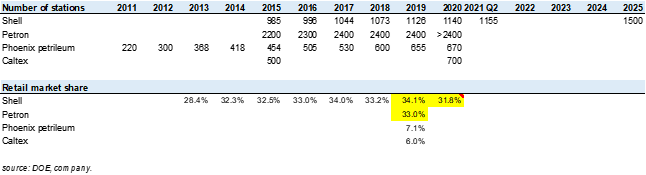

As at end-2019, P.Shell ranks number one in the country with 34.1% retail market share. It is remarkable to note that it operates only half the number of stations as compared to Petron. Essentially, each of its station operates at double the throughput of Petron.

This unrivalled level of efficiency can be attributed to a combination of the following factors:

Disciplined capital allocation approach to its retail network expansion, driven by network efficiency and stringent network selection.

High concentration of petrol station in major cities which tend to have high car population density. This also explains for the drop in retail market share in 2020 because there were more Covid-19 lockdown measures imposed on major cities.

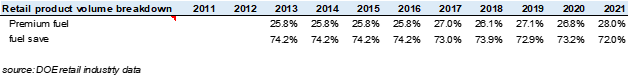

Powerful branding and mindshare of Shell. It can be further demonstrated in the premium fuel (V-Power) penetration in the table below. V-Power penetration moves up from 25.8% in 2013 to 28% in 2Q 2021. The high level of premium fuel penetration reflects consumers associates Shell brand with better quality.

Industry demand

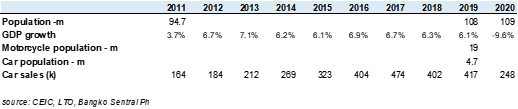

Demand for petroleum products grew at compounded annual rate (CAGR) of 6.1% between 2011 and 2019, in tandem with the strong GDP growth of the country during that period. Covid-19 reduced the demand by 21% in 2020.

The demand for diesel versus gasoline stands at a ratio of 1.8:1. This reflects the ratio of commercial vehicles population to passenger vehicles population of roughly 2 to 1.

P.Shell derives 40% its sales volume from commercial customers, which includes the supply of aviation fuels to airlines via its extensive network in airports as well as selling to agriculture, construction, utility, and industrial sectors. The balance 60% sales volume comes from its retail network.

New car sales grew at a CAGR of 11% between 2011 and 2019 on the back of strong economic growth pre-Covid. Philippines has 3x the human population of Malaysia but its car population is only 1/3 of Malaysia. The country had been growing faster than Malaysia and the trend is likely to continue post-Covid. We believe there is still a lot of room for Philippines new car sales and car population to grow in the future.

Given the stage of development of Philippines, commercial vehicles represent roughly two-third of new car sales as compared to one-third for passenger vehicles. This is also reflected in the ratio between diesel and gasoline consumption.

Profitability and growth

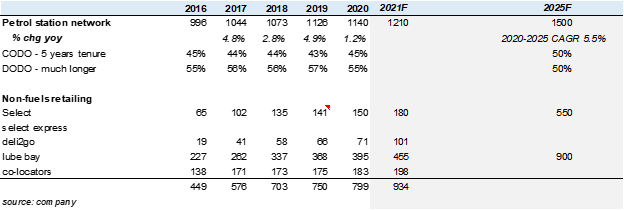

P.Shell targets to grow its Petrol station network to 1500 in 2025, representing a CAGR 5.5% over a 5-year period. It also aims to grow the profit contribution from non-fuel retailing by 15% per annum. We believe there are still a lot of opportunities for its non-fuel retailing business to grow by adding more Select store, deli2go kiosk, lubricant changing bay as well as co-locators (i.e., Mcdonald, Jollibee, Starbucks & etc).

P.Shell marketing operation has been growing gradually and earned a PAT of PHP8bn in 2019. As mentioned, its superior business economics had been masked by the volatility created by the refinery operation. The refinery was shut down in Aug 2020 as the management believes the regional oversupply of refinery capacity would persist for a long time.

P.Shell reported PHP2bn core PAT in 1H21 despite volume was down by 25% due to Covid-19 related lockdowns. Given the high operating leverage of its marketing operation, we believe it is going to make at least PHP8bn a year when Covid-19 is over. In the recent investor’s day, the management has set a target annual operating cash flow of PHP16-17bn in 2025 (which equals to at least PHP10bn of PAT).

Capital Allocation

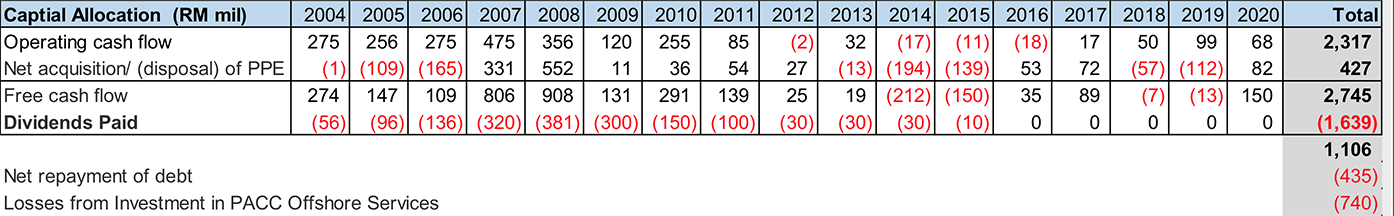

The company generated total operating cash flow of PHP45bn since listing in 2016. Total CAPEX and lease payment amounts to PHP25bn with a balance free cash flow (FCF) of PHP20bn. Nearly all its FCF was paid out as dividend to shareholders.

The company has a dividend payout policy of minimum 75% of PAT. Given the world class corporate governance of Royal Dutch Shell group, the management is likely to continue paying out all the free cash flow back to shareholders over time.

Prior to 2021, a big chunk of its annual CAPEX was forced to spend on its refinery operation which has subpar business economics. Going forward, the company would spend between PHP3bn to PHP4bn a year to grow its marketing operation more aggressively. Based our estimated payback of roughly 4 years for new station, couple with the growth from its non-fuel retailing business, it should be able to grow the company bottom line by close to 10% per annum.

Bonus: Fuel Marking

The high level of excise tax & import duty on crude and petroleum products creates significant arbitrage opportunities that are exploited illegally by smugglers, robbing nations of much needed fiscal revenue. Smuggled petroleum products are estimated to represent between 20% and 25% of total demand. This has resulted in massive revenue loss to the government and put law-abiding petrol station operators at a disadvantage position.

In Sep 2019, the Philippines government began to implement fuel marking by injecting chemical marker (i.e., security ink) into duty paid petroleum products. The nationwide fuel testing and program enforcement on the retail side started on Feb. 3, 2020. Unfortunately, Covid-19 reduced the demand for petroleum products significantly since Mar 2020 hence it has been difficult to quantify the effectiveness of fuel marking program. Nevertheless, Finance Secretary Carlos G. Dominguez III said rising tax revenues from fuel marking was proof that oil smuggling was on the decline.

A study carried out by Asian Development Bank shows that fuel marking program has significantly increased tax revenue for Ghana and Serbia. Several other studies show that fuel marking program generates very high ROI for both government as well as oil companies and reduces smuggling activities by between 50% to 90%.

If we assume the Philippines fuel marking program could reduce smuggling activities by half, it will then expand the duty-paid market size by around 15%. In the case of P.Shell, it could translate into an additional 15% in volume and roughly PHP1.5bn in bottom line.

Potential Impact from battery electric vehicles (BEV)

Global BEV sales increased by 35% to 2.3m units in 2020 and It represents 3% of global vehicle sales. Global BEV is expected to grow by another 80% this year to 4m units, representing 5% of global vehicle sales. These data seem to show that BEV is taking over the world, however, a deeper look into the BEV market structure and pricing may present a somewhat different picture and its potential impact on P.Shell.

Let’s consider the following points:

Commercial vehicles represent two-third of Philippines vehicle sales whereas most of BEV in the market are premium passenger BEV. Currently, there are very limited options for commercial BEV. The current price of BEV bus and truck are 2x to 4x higher than petroleum driven one. Some of the richer cities around the world are adopting BEV bus thanks to government subsidies. In the case of Philippines, it is unlikely for most of the commercial vehicle owner to switch to BEV given the massive price differential unless government decided to subsidize heavily.

BEV sales are heavily influenced by government policies and subsidies/waiver of import duty. Nearly all the sales are concentrated in EU, China, and USA where the government is spending large sum to incentivize the building of charging infrastructure as well as enacting policies to reduce emission.

Most of passenger BEV in the market are targeting the top 20% of the population given the high selling price. Generally, EVs are significantly more expensive than their ICE equivalents. In the UK, the difference is between 30% to 75% more for an electric version. It would take several more years before truly mass-market priced passenger EV with decent range (i.e., >400km) to become widely available.

Overall, given a very low base of car ownership, likelihood of fast economic growth and high proportion of commercial vehicles sales, the total market size for P.Shell is likely to grow for another decade before BEV begins to represent a major portion of new car sales. If we assume that Philippines new car sales continues to grow gradually over the next decade to 800k per annum, by 2030 car population would cross 10m for a country with 125m population. Majority of the car population then would still be running on petrol/diesel for another 5 to 10 years before it is replaced by (perhaps) BEV.

Summary

P.Shell is the clear leader in its industry in terms of business economics, corporate governance, and prospect. We believe its superior operations, branding and location selection would enable it to generate a stable ROE of at least 25% per annum post Covid-19.

The market cap of P.Shell is currently at PHP30bn. Conservatively, it would be able to earn PHP8bn to PHP10bn p.a. post Covid-19 and pay out a minimum of 75% per annum. It translates into a prospective PE of between 3x and 4x with dividend yield of between 20% and 25%. (Reader should take note that there is withholding tax on dividend paid to non-resident). Given the excellent corporate culture and system of Royal Dutch Shell Group, we believe the management would continue to deliver on its target and channel the prize money to the owner.

Notes and Disclaimers

This essay and the information contained herein is not a specific offer of products or services. Information on this essay is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

Oaklands Path may be long or short the securities mentioned herein and has no duty or obligation to disclose or update our action on these securities.

This essay contains information and views as of the date indicated and such information and views are subject to change without notice. We have no duty or obligation to update the information contained herein. Further, we make no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. Moreover, independent third-party sources cited in these materials are not making any representations or warranties regarding any information attributed to them and shall have no liability in connection with the use of such information in these materials.