Saas transition and IFCA MSC

13 June 2024

(The following is an excerpt from our May 2024 Newsletter)

Instead of buying traditional software upfront, Software as a Service (SaaS) allows users to subscribe to applications, typically paying a monthly or annual fee. This model is like renting software, with access granted through the cloud. Think of familiar examples like Microsoft 365 subscriptions or cloud storage services from Apple or Google.

The distinguishing feature of SaaS compared to other software delivery models is that it separates "the possession and ownership of software from its use".

The way revenue gets recognized changes dramatically when a company switches from selling software upfront to a SaaS model. For example:

Upfront Sale: With a one-time purchase of MYR 36k, the company recognizes the entire amount as revenue in the year of sale.

SaaS Model: The revenue is spread out. Say with a monthly subscription of MYR 1k, only MYR 12k (12 months * MYR 1k) would be recognized as revenue in the first year.

This shift means the company will see a lower initial revenue with SaaS, but it creates a more consistent revenue stream throughout the subscription period.

One of the best examples of SaaS transition is Adobe. You may refer to this interview aptly named “Reborn in the Cloud” for more info.

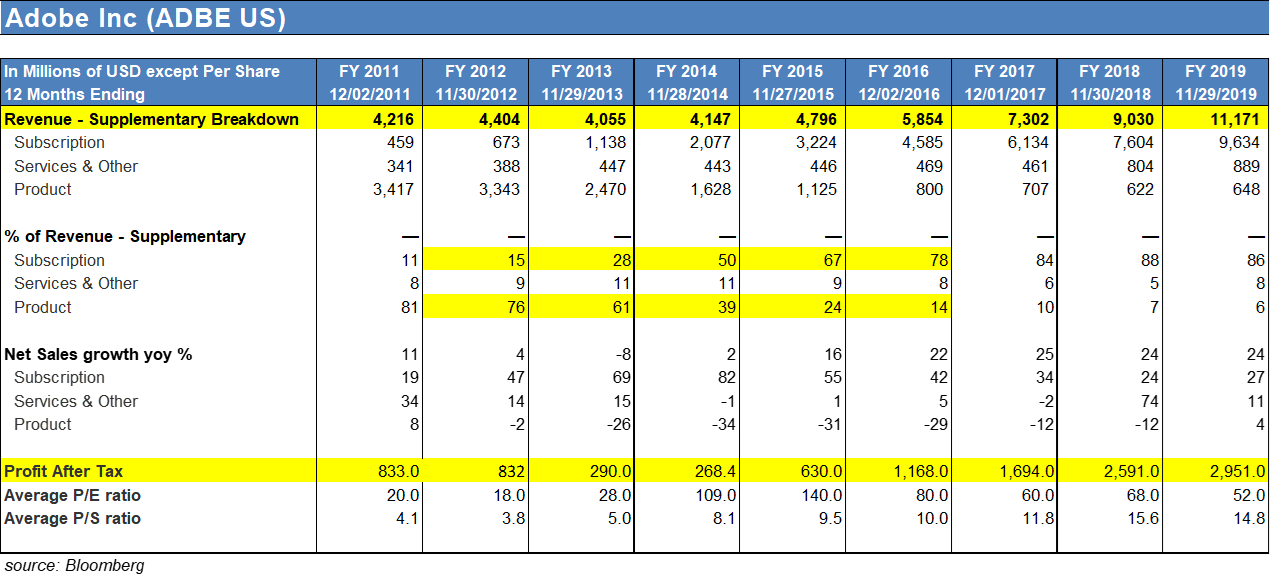

Facing stagnant sales growth for years, Adobe embarked on a bold move in 2011: transitioning to a SaaS model. This decision aimed to lower the barrier to entry for customers and allow Adobe to deliver continuously improving software. While the initial switch caused a temporary dip in revenue in 2013 (as upfront sales converted to recurring subscriptions), overhead remained constant. This led to a profit slump for the next few years.

By 2015, subscription revenue soared to 78% of the total, and profits reached record highs. This growth trajectory continued fueled by the reliable income stream.

Investors took notice. The company's price-to-earnings ratio (P/E) jumped from 20x to 50x, reflecting a shift in focus from upfront sales to metrics like annual recurring revenue (ARR), subscriber base, average revenue per user (ARPU), and backlog/deferred revenue. These metrics better represent the predictability and long-term value of the SaaS model.

IFCA MSC

IFCA is a vertical software company serving the real estate, hotel and construction industries. It has roughly 75% market share in the property management software market in Malaysia; over 70% market share in Indonesia and it also has over 110 customers in China.

Its clients in China includes Wanda, XinTianDi, JD logistics, Alibaba, XiaoMi, Meituan & etc. The business in China has grown well for many years but got hit by the sharp downturn in China property market in the last two years.

There are 3 major drivers for IFCA in the next few years:

- SaaS transition: IFCA has started the transition towards SaaS model for its hotel management, construction management, property sales lead management (CRM) and human resource management system. However, the SaaS transition for its core property management software is just about to start. Currently, recurring revenue represents around 45% of total sales (inclusive of both SaaS and maintenance income) and is growing. Overall, the SaaS transition is likely to take 4-5 years to complete.

There are at least 4 benefits of a SaaS model:

Lower entry price. it is just a much easier decision to pay RM1k per month rather than RM36k upfront. Theoretically, it can be terminated anytime but the switching cost in the form of learning curve (time invested) and data migration risk is very high. Given that not all competitors are offering SaaS, it enables IFCA to grab significant market share among the newly formed property companies.

Enhanced User Experience. The traditional software model often involved infrequent upgrades, with new features bundled into major releases every few years. Customers then faced a choice: upgrade and pay extra, or stick with the possibly outdated and potentially "clunky" software they already had. This could lead to security risks and hinder overall user experience. The SaaS model flips this script. With continuous revenue from subscriptions, software companies are incentivized to continuously improve their offerings. New features and updates are rolled out regularly, ensuring customers always have access to the latest and most secure version of the software. This translates to a superior user experience for IFCA's clients.

Broaden distribution channel. In China, IFCA has always been selling directly to end-users in the past two decades. It is more difficult to recruit resellers under conventional upfront sales model as the commission is one-off. It has now started selling through resellers in China under the SaaS model, broaden its market reach. The SaaS model also enables IFCA to target global market via reseller.

More opportunities to raise prices. Under the SaaS model, given the high switching cost, companies have more opportunities to raise prices. So long as the price increase is reasonable, customers won’t take the risk and move elsewhere.

- Riding the E-Invoicing Wave: Malaysia is mandating e-invoicing for businesses, with a phased rollout. The first group, companies exceeding RM100 million in annual turnover, starts on August 1st, 2024. Subsequent phases bring on board companies with lower turnover thresholds (RM25 million+ starting January 1st, 2025, and all remaining taxpayers by July 1st, 2025).

IFCA offers a separate e-invoicing module, priced from RM40,000+ to RM400,000+ (It has more than 1,000 customers in Malaysia). Additionally, unlike a one-time GST upgrade (referencing a previous government initiative), IFCA's e-invoicing solution generates recurring revenue of close to 20% of the initial license fees. This ongoing revenue stream stems from the complexity of e-invoicing. As government regulations evolve, IFCA will need to continuously develop and update their solution to ensure compliance.

- **Potential for software upgrades:* IFCA has invested heavily (both time and money) in developing a next-generation property ERP platform – a mobile and cloud-based solution. This represents a significant leap forward compared to the first-generation systems still used by all Indonesian customers and the mostly second-generation desktop products relied upon by Malaysian customers.

Our channel check indicates a strong customer preference for bundled upgrades. Many are eager to adopt the new platform along with the e-invoicing module in a single upgrade process, achieving a "one-time fix" for their software needs. This presents a strategic opportunity for IFCA to not only capture the e-invoicing wave but also nudge clients to modernize their legacy systems and unlock the benefits of the latest technology. Given that IFCA’s capacity would be occupied with e-invoicing jobs in the next 18 months, most of the upgrading works would be scheduled to happen after that.

One of the main pain points for customers is managing their in-house servers, as it is becoming increasingly difficult to hire skilled IT personnel for the task. Since the clients are all property companies, the HR department struggles to identify suitable candidates and lacks the knowledge to ask the right questions during interviews. As a result, an increasing number of customers recognize the significant benefits of cloud hosting and comprehensive suites of cloud-based applications.

Currently, IFCA employs over 500 staff in China, Malaysia, and Indonesia. Their large teams of talented engineers in China and Malaysia have developed a superior product with an exceptional user interface and user experience, outperforming competitors. Part of their workforce has been focused on developing comprehensive Human Resource Management software, which has begun generating sales and is profitable with 110 customers.

The company’s monthly overhead costs are now RM6 million. With anticipated growth from increased SaaS revenue, e-invoicing upgrades with recurring income, and other upgrade opportunities, the company is likely to achieve strong profitability. IFCA has been paying dividends since 2015, except for 2022, and it is expected to move towards a higher payout ratio in the future as it does not require cash to grow the business. Following its SaaS transition, the company's cash flow is expected to resemble an annuity with growth, potentially leading to a rerating of its P/E and P/S multiples.

Notes and Disclaimers

This essay and the information contained herein is not a specific offer of products or services. Information on this essay is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

Oaklands Path may be long or short the securities mentioned herein and has no duty or obligation to disclose or update our action on these securities.

This essay contains information and views as of the date indicated and such information and views are subject to change without notice. We have no duty or obligation to update the information contained herein. Further, we make no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. Moreover, independent third-party sources cited in these materials are not making any representations or warranties regarding any information attributed to them and shall have no liability in connection with the use of such information in these materials.