Mega First Corporation Berhad (MFCB) – A Publicly Traded Private Equity Like Platform

24 September 2024

MFCB is a company we have invested in since 2015, and we have written about it several times in the past. It consistently surprises us positively with its ability to penetrate and succeed in seemingly unrelated new businesses. At first glance, it may seem a little complicated given the number of industries it operates in. However, if we view it as a businessman-led permanent capital private equity (PE) platform that continually redeploys capital efficiently, then things start to make sense.

A brief history of MFCB

- Founded: 1966

- Listed: 1970

- Current Management: Led by Mr. Goh Nan Kioh, a serial entrepreneur, who took over in 2003.

Business Overview at the Time of Takeover (2003)

- Thermal Power Plants: Serudong Power in Sabah and Shaoxing power plant in China.

- Resources Business: Producing quicklime and calcium silicate bricks.

- OEM Business: Manufacturing automotive components through Bloxwich in England, Malaysia, and South Africa.

- Property Development.

Financials in 2003

- Revenue: RM377 million

- Adjusted PATAMI: RM19 million (80% from power division)

- Net Debt: RM128 million

- Shareholders’ Equity: RM224 million

- ROCE: 12%

- ROE: 10%

Key Developments

- Restructuring: Exited unprofitable businesses, including Bloxwich overseas, changed management, streamlined operations, and implemented proper processes and controls.

- 2005: Invested in an associate stake in Hexachase to support a hungry startup headed by Danny, Chai and Sim.

- 2009 Financials: Revenue of RM463 million, adjusted PATAMI of RM54 million, shareholders’ equity of RM440 million, net cash of RM130 million, ROCE of 19%, and ROE of 14%.

- 2008: Signed a development agreement with the Laos government to build, operate, and transfer the 260MW Don Sahong hydropower plant (DSHP). Overcame initial resistance from NGOs by conducting environmental and aqua life studies and building river bypass systems for fish migration. This process took them several years and RM50m before the project was started.

- 2012: Completed the privatization of RCI, making its resources division a wholly owned business.

- 2013: Obtained a land concession in Cambodia to develop a plantation on 6,420 hectares. By 2024, planted 1,830 hectares of coconut and 730 hectares of macadamia.

- 2015: Due to a weak outlook, MFCB halted new property development projects and shifted focus to divisions with sustainable returns while maintaining rental income from existing properties.

- 2016: Started construction of DSHP, partially funded by a rights issue with warrants. Completed ahead of schedule and under budget in January 2020. The project generates close to USD100 million in free cash flow annually, with an all-in CAPEX of around USD400 million and a realized payback period of under 4 years. The concession expires in 2045.

- 2017: Both thermal power plant concessions (Tawau and Shaoxing) expired.

- Renewable Energy Focus: With the start of DSHP, MFCB transformed into a renewable energy company, deriving over 90% of its profit from renewable energy. The management has committed to focusing solely on renewable energy for its power generation business, avoiding any further thermal plants running on fossil fuels.

- 2019: MFCB incorporated MFP Solar to enter the solar business. In 2020, it acquired 100% of Mega First C&I Solar to undertake solar PV projects in Malaysia. By mid-2024, it had 29MW of solar power plants in operation, with an additional 67.1MW expected by the end of 2025.

- Growth in Flexible Packaging: As DSHP development progressed smoothly, management shifted focus to growing its flexible plastic packaging business, Hexachase. In 2014, MFCB acquired a 65% stake in Hexachase Flexipack Sdn Bhd. In 2021, it acquired 75% of upstream BOPP and LLDPE film maker Stenta, enhancing the division’s competitiveness through full integration.

- 2021 Oleochemicals JV: MFCB was invited to form a 50:50 JV with Mr. Yeow Ah Know (AK) and his team, veterans in the oleochemical space, to take over a loss-making oleochemicals plant from Sime Darby. MFCB serves as the financial partner, assisting in due diligence and business strategy, while operations are managed by the experienced team.

- 2022 Investment in IST: MFCB invested a 28.8% stake in Integrated Smart Technologies Sdn. Bhd. (IST), an automated assembly and test equipment (ATE) maker formed by three businesses with complementary expertise. IST is a key equipment (i.e. high-speed sorters and tapes) supplier to D&O Greentech.

- 2024 Coconut and Food Products: MFCB decided to focus on producing coconut palm syrup (gula Melaka) and food product as its plantation begin to mature. They also plan to acquire minority stake in a downstream coconut sap products maker in Thailand, improving productivity and securing distribution channels.

- 2024 Further Expansion In Modern Farming: acquired a 40% effective stake in CSC Agriculture Holdings (CSC), a company involved in fruit and vegetable farming with wholesale operations. Prior to this acquisition, MFCB conducted extensive research on designing and constructing cost-efficient greenhouses.

- 2024 Hospital: MFCB purchased land adjacent to Setia City Mall, with plans to construct a hospital. This decision was driven by a group of top specialists’ doctors with a shared vision of designing and building a high-quality medical facility.

A business platform with PE-like capabilities

As demonstrated, MFCB not only initiates new ventures from the ground up but also invests in other businesses like a PE investor. A key to success in the PE business is the quality of the team and its investment philosophy. MFCB's team is proven, experienced, and well respected. Their goal is to grow earnings power over time, and their investment philosophy can be summarized by two core principles:

- “Any business can make money, it is the people that matters,” says CEO Mr. Goh

- “The most important investment criteria for us is whether we have the right people and whether they are like-minded. If they are, we will back them if it is a scalable industry,” says Director Mr. Yeow See Yuen.

MFCB's investment strategy emphasizes risk management and certainty. They start with a smaller initial investment and only scale up once the business model and team have proven their value and the venture shows strong potential. This approach was evident in their investment in Hexachase, where they initially took an associate stake and only later made a significant investment to turn it into a subsidiary once it had demonstrated success. A similar method was applied to the Oleochemical JV, where MFCB invested RM20 million to support a group of hungry and experienced entrepreneurs, and it is worth nothing that the replacement cost of the asset being RM1.1 billion. In their plantation ventures, they spent several years researching and testing various crops before committing heavily to coconut and macadamia.

This PE-like process begins with sourcing potential deals and evaluating the characters, working culture and values of prospective business partners to see if it would be a good fit with MFCB culture. Much like traditional private equity, the process follows these key steps:

- Deal sourcing.

- Negotiation.

- Due diligence.

- Deal completion and funding.

- Post-deal management and exit.

Unlike many companies that excel only within their core business areas, MFCB has a highly capable internal deal team that sources and executes attractive transactions across various industries. This success in sourcing is driven not just by networking but by MFCB's strong reputation and culture, which draw in like-minded business partners. Known for being a fair and value-adding owner, MFCB consistently attracts top-tier managers who share its culture and value system—truly embodying the adage, "birds of a feather flock together."

While traditional private equity firms often act solely as financial investors, MFCB goes further by adding value post-investment—an essential trait of successful serial acquirers, as highlighted by Ryan Kraft from Scott Management.

As Kraft aptly puts it, "Acquisitions are the easy part—the real challenge lies in everything that happens before and after the deal." For a company to succeed in M&A, it must have key foundational elements firmly established before the transaction. They need clear answers to questions that can often become murky when focusing on external growth rather than organic expansion. These include: "What are our core values?" "How would we define our culture, infrastructure, and performance measurement systems?" and "Who is responsible for overseeing due diligence, onboarding, and integration?"

MFCB's added value after investment includes:

- Leveraging its broad business network.

- Providing strategic guidance with insights with its collective business acumen and experience.

- Enhancing financial management, reporting, and streamlining corporate structures.

- Recruiting key talent when necessary.

- Conducting in-depth research into potential vertical or horizontal acquisitions.

- Structuring, negotiating, and performing due diligence for mergers and acquisition.

- Continuously analyzing and refining business models for improved efficiency.

- Supporting growth and M&A activities with a robust balance sheet.

- Setting thoughtful financial targets and incentives.

While there is limited synergy between RE, Plantation and Flexible packaging platform other than shared culture and business acumen, bolt-on acquisitions conducted within each business platform creates large synergy. For example, they acquisition of Stenta under flexible packaging and the acquisition of stake in downstream coconut product under plantation.

Let’s examine the recent developments in some of MFCB’s businesses:

- Power generation. The fifth turbine at the Don Sahong Hydropower Plant (DSHP) became operational in July 2024 and is expected to generate an additional RM50 million in profit after tax (PAT) annually, with a payback period of just three years. MFCB has also increased its ownership in DSHP from 80% to 95%, which will contribute an extra RM50 million in PATAMI annually, starting this year. DSHP is expected to begin paying taxes in Laos from 2026 onwards. MFCB is currently finalizing the renegotiation of the power purchase agreement (PPA) to incorporate the fifth turbine. The timing of the fifth turbine is strategic, as MFCB plans to carry out a major overhaul on one turbine each year for the next four years, starting during the dry season, which the fifth turbine will help offset to minimize potential revenue loss. Additionally, MFCB is actively pursuing new hydropower development opportunities, including both greenfield and brownfield projects.

In terms of solar power, its photovoltaic (PV) capacity is projected to reach 96MW by the end of 2025. Once fully operational, this division should generate RM40m of revenue with around 30%-40% profit margin.

Resource business. By 2018, MFCB had expanded its resource business capacity from 760 tons/day to 1,960 tons/day. However, earnings didn't immediately reflect this growth due to the time needed to ramp up capacity and the quadrupling of pet coke prices, a key energy source. With pet coke prices normalizing and both ASP and capacity utilization improving, this business is poised to double its PAT from RM20 million to RM40 million this year.

Oleochemical. In 4Q 2021, MFCB was invited to form a JV called Edenor with AK & team. Each party contributed RM20m in paid-up capital. They acquired the oleochemical business for RM12.6 million, which came with a net debt of RM205 million. In 2023, MFCB recognized a gain from the bargain purchase amounting to RM125 million. The replacement cost of the oleochemical plant is estimated to be RM1.1 billion. AK, the former managing director of KLK’s oleochemical division, has a strong track record and invested heavily in the venture. Within two months, the loss-making operation was turned around. However, frequent shutdowns for upgrades and maintenance, combined with an oversupply in the oleochemical market, led to reported losses of RM24 million in the first half of 2024. Despite this, management believes that most upgrades are now complete and expects positive contributions in the second half of 2024. Over time, the plant is expected to generate annual revenue of RM1 billion to RM1.5 billion with a mid-single-digit profit margin.

Flexible packaging. MFCB has been involved in flexible packaging since 2004, but this division only saw significant growth in recent years. It includes upstream film production (LLDPE, BOPP, and MPP films) through Stenta (acquired in 3Q21) and downstream conversion via Hexachase. This division generated RM11 million in PBT in 2020, with expectations of nearly RM35 million in 2024. It continues to invest in expanding capacity and capabilities to capitalize on growing demand, with ambitions to triple this business over the next few years.

Food security. MFCB’s food security division comprises two key businesses. First, its coconut and macadamia plantations in Cambodia, where by 2024, 1,830 hectares of coconut and 730 hectares of macadamia had been planted. After years of research and iteration, MFCB decided to harvest flower sap to produce coconut palm syrup (gula melaka) and food products through its Thai subsidiary (acquired in 2024). As the planted areas mature, this business may generate RM40-70 million in annual profit over the next five years. Notably, macadamia is one of the highest-value crops per hectare.

The second is its 40% effective stake in CSC, focused on fruit and vegetable farming on its 1100 acres of open-air farmland. After MFCB went in, it introduced a modern greenhouse farming model to improve quality, supply consistency, productivity, eliminate the use of pesticide, and enabled it to target organic produce based on customers’ requirements. The predictability allows it to enter long-term supply agreements with supermarkets, which is a win-win for both parties by taking out several layers of middlemen (i.e. importer, stockiest & wholesaler). They are now working on scaling it up substantially. We expect it to generate RM200m in revenue with profit margins in the teens range over time.

Malaysia is a net importer of fresh vegetables, with data from the Department of Statistics Malaysia (DOSM) showing a net import value of RM3.1 billion in 2023, accounting for over 45% of the country's total consumption. According to the Ministry of Plantation Industries and Commodities, the total area dedicated to vegetable farming is just 88,000 hectares. The total production value of vegetables in Malaysia was RM4.4 billion in 2023. This presents a substantial opportunity for large-scale vegetable farming operations if executed properly.

- Hospital. MFCB is working with a group of top-tier specialist doctors to design and build a hospital in Setia Alam. A hospital is a business which generally requires high upfront CAPEX and long gestation period. It is kind of chicken-and-egg as if there aren’t enough good doctors then there won’t be many patients in the beginning and vice versa. Normally, it takes a new hospital at least 3 years to reach breakeven but given the expected patient draw from these specialists, management expects it to be much shorter than that. Once established, the hospital will be a prized asset. For comparison, IHH recently announced plans to purchase the 500-bed Island Hospital for RM3.92 billion, valuing it at 24.6x EV/EBITDA and a P/E ratio of 53x.

Financials

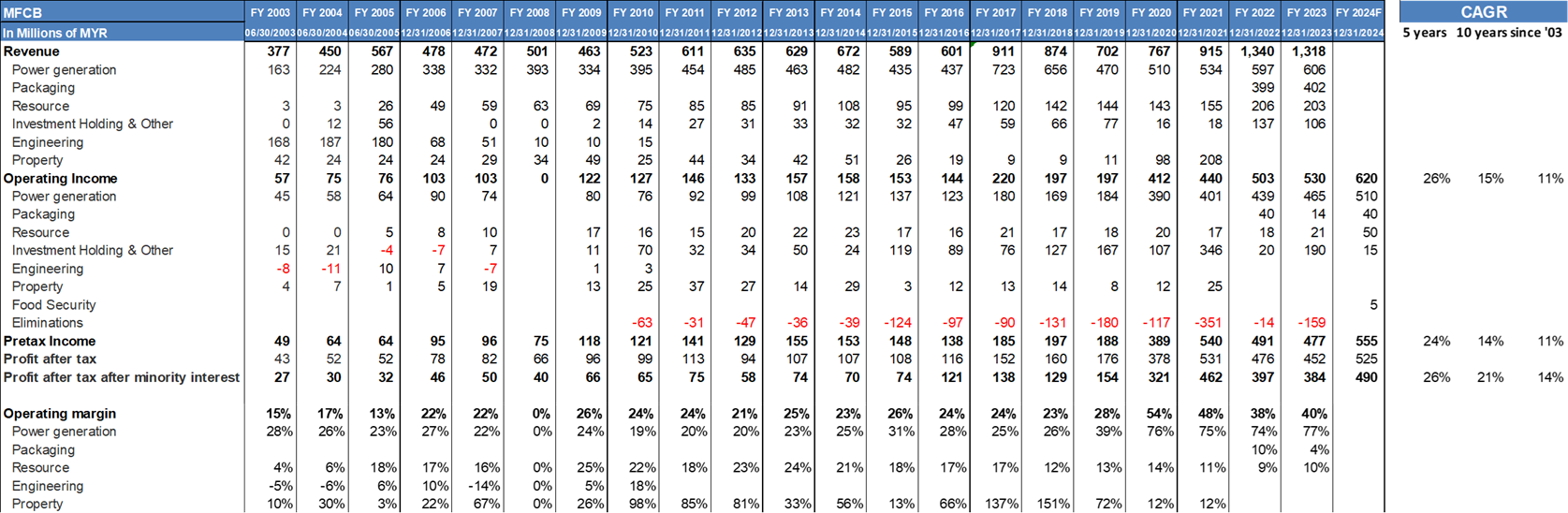

source: bloomberg and company AR

source: bloomberg and company AR

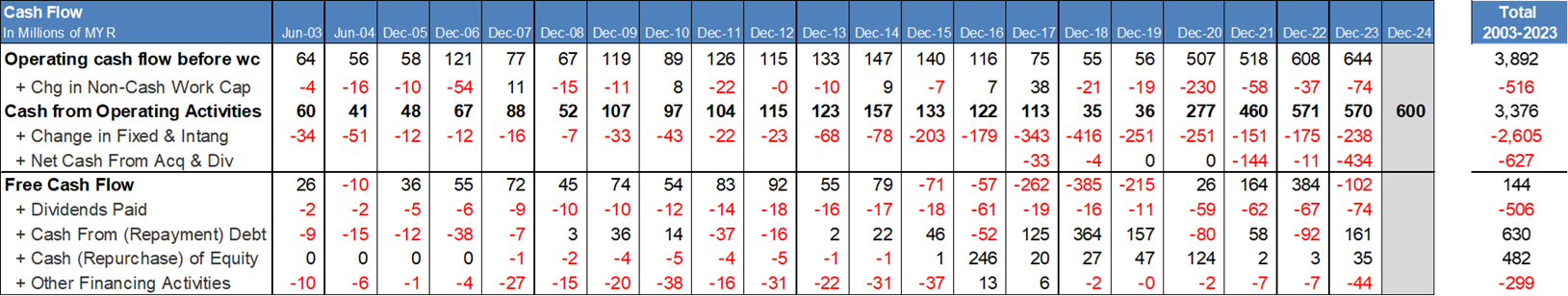

MFCB PATAMI grew at a compound rate of 14% since 2003 and is expected to reach RM490m this year. Considering the future growth from oleochemical, solar, food division and flexible packaging, while offsetting by income tax on DSHP starting in 2026, we still anticipate the overall profitability to increase in the next three years.

Since 2003, MFCB has generated RM3.9 billion in cumulative operating cash flow (OCF). Of this, RM0.5 billion was used for working capital, RM2.6 billion was invested in CAPEX (with about 80% allocated to DSHP), and RM0.6 billion was spent acquiring additional stakes in DSHP, Stenta, and other businesses. The company has also paid RM0.51 billion in dividends and raised RM0.48 billion through rights issues and warrants to fund DSHP. From 2015 to 2019, MFCB was in a major investment phase, but from 2020 onwards, it entered a "harvesting" phase, with annual OCF reaching RM600 million in 2024. This level of OCF is considered sustainable without requiring substantial additional CAPEX.

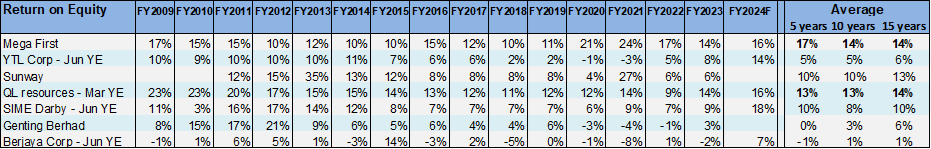

Long-term ROE figures demonstrate how effectively management uses shareholders' funds to generate returns. If a company's price-to-book ratio remains constant, an investor's long-term returns would essentially mirror its ROE.

The table highlights the long-term ROE of some well-known Malaysian conglomerates/ holding companies. While conglomerates are often criticized for low returns and empire-building, not all are alike. For instance, Berkshire Hathaway is the largest conglomerate in the world with over 70 large subsidiaries, and it's highly regarded as an efficient capital allocation platform. Similarly, though MFCB operates multiple distinct business lines, this diversification is the result of its PE-like platform and entrepreneurial spirit.

Over the past 15 years, both MFCB and QL Resources have achieved the highest average ROEs, with MFCB pulling ahead in the last five years following the commencement of operations at DSHP.

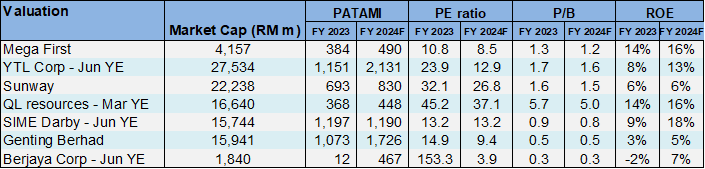

Valuation & Summary

Despite delivering strong returns on equity, MFCB remains undervalued, trading at just 8.5 times its current year P/E. This contrasts sharply with QL Resources, which operates in at least five distinct sectors—ranging from poultry and wholesaling to plantations and retail—while generating similar levels of PATAMI and long-term ROE, yet trades at a much higher 37 times P/E multiple.

Companies with diverse business lines often trade at a discount to their intrinsic value due to issues such as opaque and inefficient capital allocation. High returns in some subsidiaries may not reflect at the group level due to varying capital structures or poor investment discipline. Parent companies may demand their subsidiaries achieve high ROI but fail to apply the same rigor to themselves. Additionally, weak disclosure practices often leave the market unsure of what is happening within the company. Transparency is key to building trust, and shareholders seek clarity during both good and challenging times—something not always guaranteed.

Notably, MFCB has held quarterly online briefings for several years, where any investor can participate through a Zoom link on the Bursa Malaysia website and ask questions. The management has shown genuine transparency in responding, making MFCB one of the few Malaysian companies to offer such openness, if not the only one.

MFCB, operating more like a permanent-capital PE platform than a traditional conglomerate, aims to grow its earnings power while maintaining high ROE. As CEO Mr. Goh states, "the challenge is to use small money to make big money (without taking on too much investment risk at the beginning)." Some businesses may eventually be listed separately, as agreed with the management of subsidiaries and joint ventures, which the market is likely to view as "value unlocking."

Many investors tend to avoid acquisitive companies, and understandably so. Research by McKinsey has found that only about one-third of acquisitions create value, while the remaining two-thirds are either value-neutral or destroy value. However, it's important to highlight that MFCB’s management has a proven track record beyond the company itself. They successfully grew Angkor Beer in Cambodia and D&O Greentech into multi-billion-dollar businesses, both starting with small amount of money. Angkor Beer, founded by Mr. Goh in the early 1990s, was reportedly acquired by Carlsberg through multiple transactions totalling a few billions MYR. Additionally, since the current management took over, MFCB’s market capitalization has increased from RM200 million to over RM4 billion today.

In terms of capital returns, MFCB's skilled management team continues to identify attractive reinvestment opportunities for its RM600 million in annual operating cash flow, primarily in the private market. As a result, rather than returning cash directly to shareholders, much of it is retained for potential future acquisitions. However, management is mindful that if such opportunities become scarce, they will avoid holding excess cash unnecessarily and instead declare special dividends. The stock market typically excludes future acquisitions from forecasts, overlooking the growth potential generated by MFCB's private equity-like platform which has a solid track record in creating value.

It has also conducted share buybacks infrequently to enhance shareholders’ value. Given the current undervaluation, we hope that this value creating tool could be employed more aggressively and timely. This approach would not only boost the intrinsic value per share for long-term shareholders but also help the market better reflect the company’s fair value, allowing long-term shareholders with liquidity needs to exit at a reasonable price, while MFCB continues to reinvest most of the cash flow for future growth.

Notes and Disclaimers

This essay and the information contained herein is not a specific offer of products or services. Information on this essay is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

Oaklands Path may be long or short the securities mentioned herein and has no duty or obligation to disclose or update our action on these securities.

This essay contains information and views as of the date indicated and such information and views are subject to change without notice. We have no duty or obligation to update the information contained herein. Further, we make no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. Moreover, independent third-party sources cited in these materials are not making any representations or warranties regarding any information attributed to them and shall have no liability in connection with the use of such information in these materials.