Interactive Brokers (IBKR) – The Best Online broker in the world

29 September 2023

As a fund manager, we are always exploring and assessing brokerage platform that provides the best execution at lowest cost, access to the widest range of markets and instruments, while also being fair and transparent with their clients. We seek a platform that allows us to have the maximum flexibility in our thinking, which to us is essential in being a good investor. The search led us to become a customer of IBKR in 2015.

Firstly, here’s how we think as a customer:

- IBKR's trading execution is by far the best and fully automated. It has over 100+ order types including market order, limit order, VWAP (volume weighted average price). TWAP (time weighted average price) etc. Our favourite is the MidPrice Algo order with an optional price cap. This order is designed to split the difference between the bid and ask prices, and fill at the current midpoint of the NBBO (National Best Bid and Offer) or better.

Another interesting order type is called pegged-to-midpoint order. For example, a trader can key in to at midpoint minus 1 cent and sell at midpoint plus 1 cent. The price would automatically adjust to peg the midpoint as the market moves in any direction. This feature essentially empowers common trader to act like a market maker.

IBKR does not sell the order flow of its PRO clients for payment. Instead, it charges extremely low commissions, which often work out to be only 2 basis points (0.02%) per order. This level of net trading cost is actually cheaper than brokers who sell your order flow and do not charge commission.

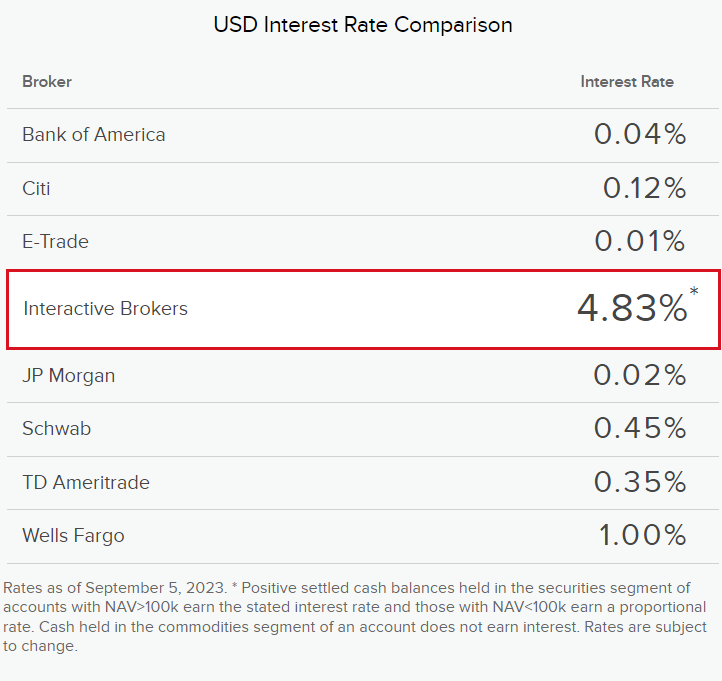

It automatically pays interest based on Fed fund rate minus 0.5% on cash balance more than USD10k. The current interest rate is 4.83%, which is significantly higher than what most other brokers are offering.

IBKR’s Insured Bank Deposit Sweep Program allows its clients to obtain up to USD2.5m of FDIC insurance in addition to existing USD0.25m SIPC coverage for total coverage of USD2.75m. Cash balances above USD2.75m is safeguarded under the SEC's Customer Protection Rule, backed by the firm's equity capital, which exceeds USD12.7 billion.

In addition to US dollars, IBKR also pays high interest rates on 25 other currencies, such as SGD, HKD, and AUD.

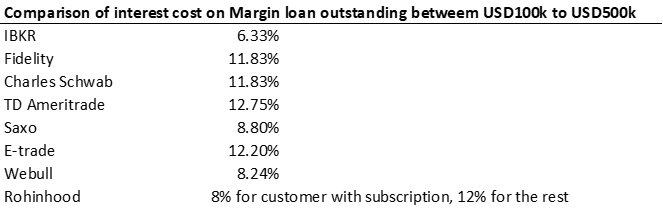

- It consistently charges the lowest interest rate on margin financing. The rate that it charges ranges from 0.5% to 1.5% above fed fund rate, which equals to around 6.33% currently.

Interactive Brokers (IBKR) has the largest and most comprehensive trading network in the world. It provides access to stocks, options, futures, forex, bonds, mutual funds, ETFs, and precious metals on over 150 electronic exchanges and market centers in 33 countries. This is due in part to its long history as a market maker, which gave it the relationships and expertise to build connections to exchanges all over the world.

On forex conversion, IBKR empowers its customer to convert currencies at the spot exchange rate without any spread. It only charges a commission of 0.2 basis point (0.002%). This is way lower than the fees that banks typically charge for currency conversion. Basically, you can convert from one currency to another other currency as frequent as you wish without feeling any pain.

On short selling inventory and rate.

In the past, there was no publicly available database that showed what shares were available to lend for short selling and at what rate. This meant that investors had to ask brokers if they had shares to lend and negotiate the rate. Often, brokers would mark up the rate that lenders were asking, sometimes by as much as 100%.

IBKR is the first brokerage firm in the world with an open book policy for short lending. This means that there is no hidden markup on the rate that lenders are asking, and investors can check the availability of shares to borrow online.

If these attributes make you want to open an IBKR account, be sure to use this link, which could qualify you for an award of up to USD1000 of IBKR stock!

Secondly, here’s our observation as an investor:

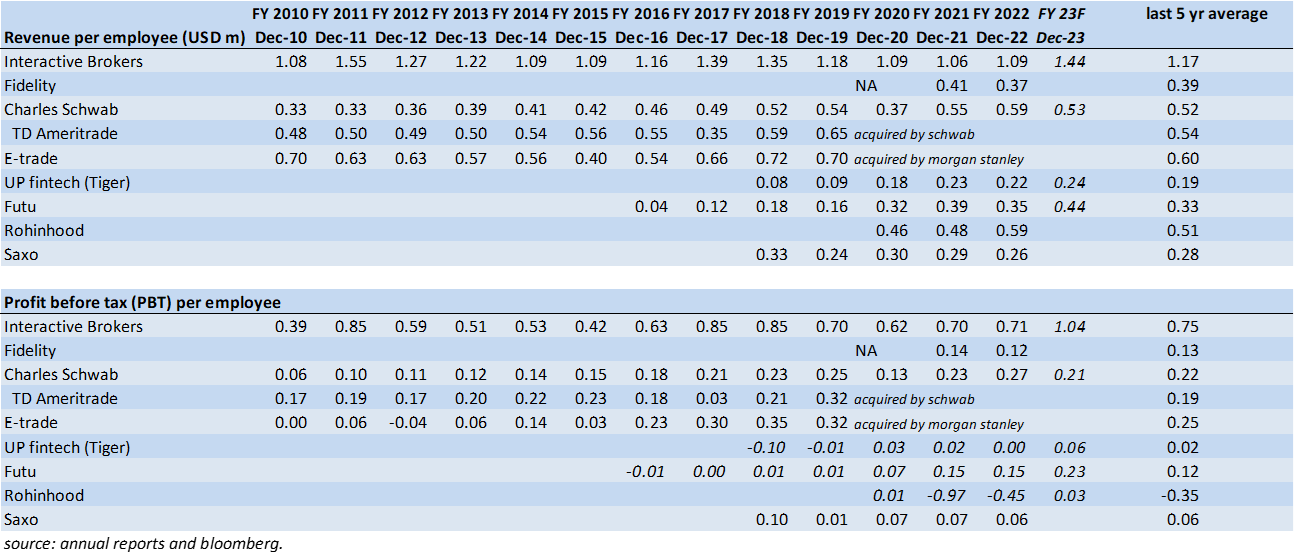

- Since IPO in 2007, IBKR revenue per employee has consistently double or triple that of its competitors, even though it offers the lowest brokerage fees, margin financing rates, and forex conversion rates, and paying the highest interest on cash balances.

Its profit before tax per employee has consistently been three times higher than that of its competitors.

IBKR’s main competitors are Charles Schwab (Schwab), Fidelity, and E-Trade (Morgan Stanley). The other competitors in the table serve slightly different customer segments and geographic locations.

IBKR revenue per employee is expected to reach USD1.44m with a PBT per employee of USD1.04m this year.

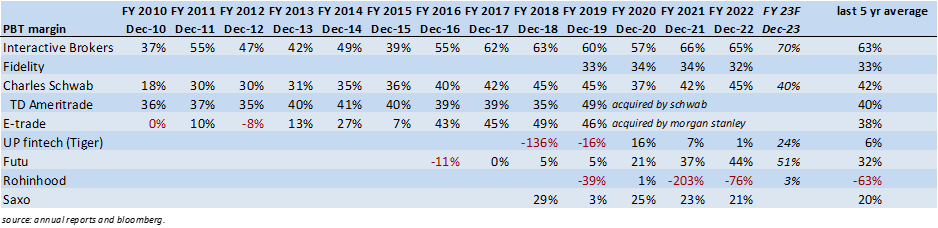

IBKR PBT margin is by far the highest in the industry and is hitting 70% this year.

Based on our simulation, if its main competitor Schwab were to match IBKR’s interest rate on customer cash balances and margin financing rates, it might no longer be profitable.

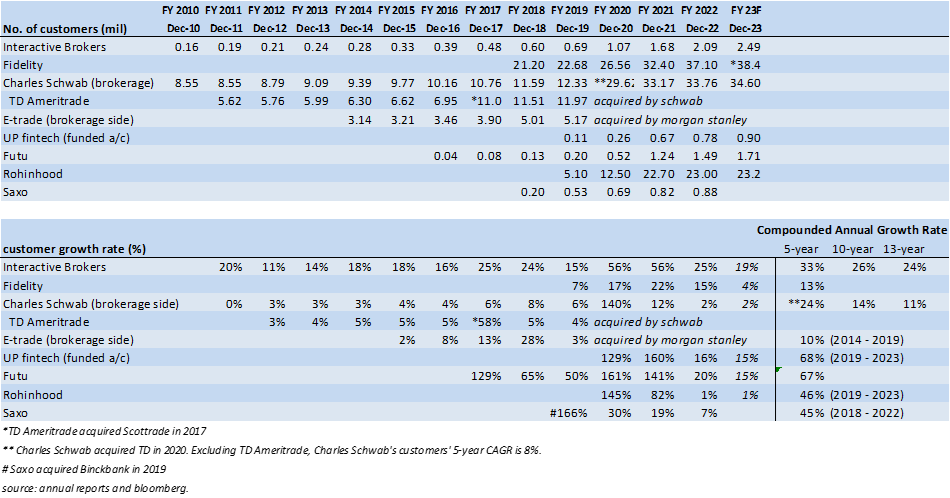

Number of customers

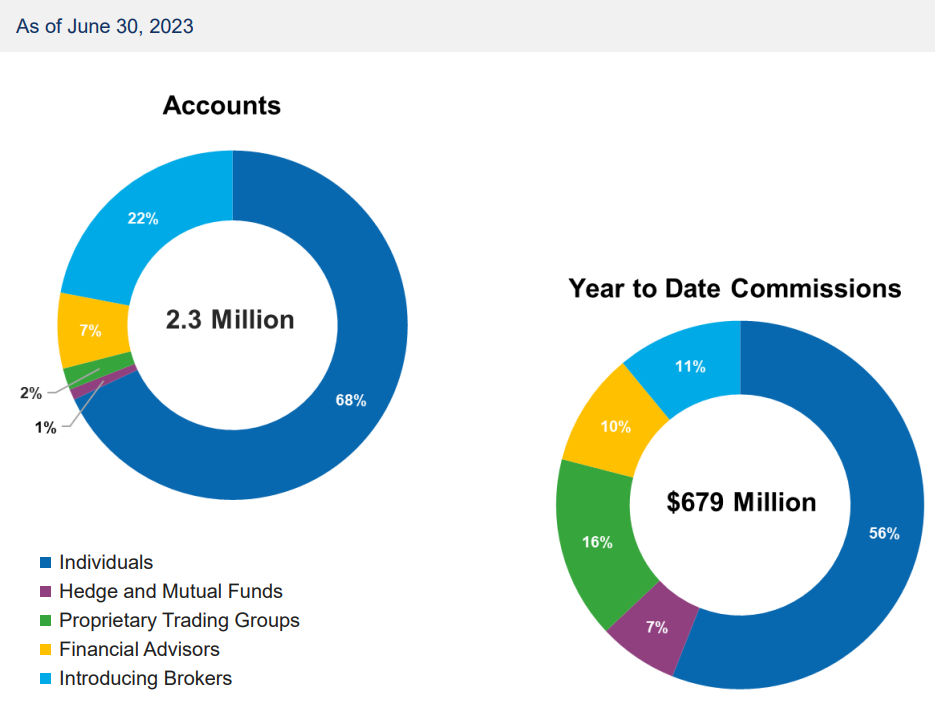

IBKR currently has 2.3 million customers, compared to Schwab's 34 million and Fidelity's 37 million. More than half of IBKR's customers is outside the United States, and they contributed 31% of the company's revenue in 2022.

It has been gaining market share for a long time, and its customer base is still growing at around 20% this year. Its founder, Thomas Peterffy, believes that the growth rate could accelerate further. The total addressable market is very large, and we believe IBKR would continue to grow at a fast pace in the coming years.

Meanwhile, IBKR's main competitors, Schwab and Fidelity, are growing at a much slower pace, at just 2% and 4% currently, respectively.

Robinhood has grown tremendously to over 20 million customers in a few years through gamified stock investing and crypto trading. Its average customer has USD 4k in assets, compared to USD 200k for IBKR customers. In other words, Robinhood is a popular brokerage firm for new investors, while IBKR is more popular with experienced investors who have larger portfolios. Robinhood customers are increasingly transferring their assets to IBKR as they become more sophisticated investors and need a wider range of products and services.

IBKR's customer base has grown at a compound annual growth rate (CAGR) of 24% since 2010 and 33% since 2018. Its customer assets, margin loan balances, and customer credit balances have also grown at a CAGR of 15% to 20% since 2010.

Platform-as-a-service (PAAS)

IBKR's platform is so efficient and comprehensive that it is used by other brokers around the world to provide brokerage services to their clients in Asia, EMEA, and other regions. These brokers are called introducing brokers. IBKR has recently won several large introducing brokers as customers, and more are expected to join this year. This is one of the reasons why IBKR founder Thomas Peterffy is confident that the company's growth rate will accelerate further.

Its PAAS offering is so competitively priced that other brokers prefer to use it rather than build their own platforms. This saves them the hassle of dealing with the regulations and compliance requirements of 33 different countries, and they can get the world's best trading execution system at a fraction of the cost of building it themselves. Meanwhile, IBKR is still able to maintain a 60% pre-tax profit margin on its PAAS service.

IBKR is also gaining market share in the hedge fund space. It recently overtook BAC-Merrill and Credit Suisse to become the fourth-largest prime broker for hedge funds by numbers, up from 10th place in 2018. More and more hedge funds are choosing IBKR as their prime broker because they like its execution and the fact that they can see its short inventory and the rate at which they can borrow various equity issues from IBKR. On average, each hedge fund account is equal in revenue to 67 retail accounts.

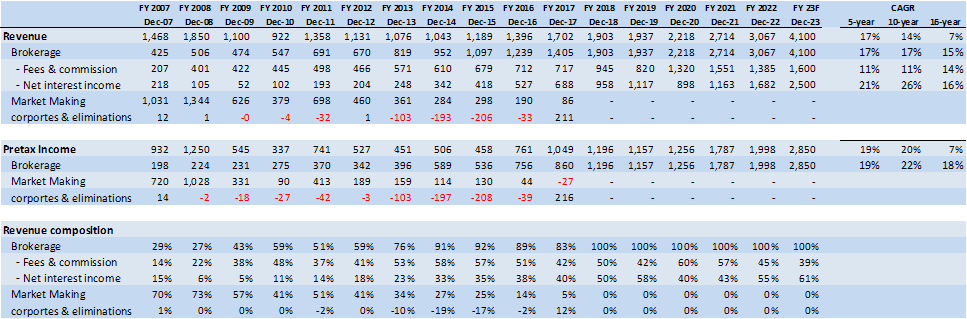

Exited market making business and net interest income trend

When IBKR first went public in 2007, market making accounted for over 70% of its revenue. However, this business gradually declined as more and more competitors began to buy order flow from other brokers and trade against those orders. IBKR refused to trade against its clients, and eventually sold its market making business to Two Sigma in 2017.

Excluding the market making business, IBKR's brokerage revenue has grown at a CAGR of 15% since 2007, while its pre-tax profit (PBT) has grown even faster, at a CAGR of 18%.

IBKR pays interest on customer cash balances based on the Fed funds rate minus 0.5%. It is currently paying 4.83% on balances over USD 10,000. It earns interest on the first USD 10,000 as well as the 0.5% spread. In 2020 and 2021, the Fed funds rate was essentially zero, so IBKR did not derive much revenue from holding customer cash balances. However, it still earned interest on its ultra-competitive margin financing and shares lending business.

Now that the Fed is raising interest rates to fight inflation, IBKR is benefiting from this and is seeing significantly higher net interest income. As long as the Fed funds rate does not drop below 1.0% on average in the future, the current level of net interest income is highly sustainable. Given the recent inflation shock, we do not think the Fed funds rate will go below 1.5% in the next 5 to 10 years, so we are not concerned about net interest income not being sustainable.

Sensitivity wise. every 100 basis point change in interest rates would increase or decrease net interest income by around USD 250 million.

- Safest broker in town

As of 2Q 2023, the regulatory capital requirement of IBKR is USD 1.3 bn, However, the company intentionally maintains a much larger shareholders fund of close to USD 12 bn, more than 9x the required capital. This is because it believes that having an ultra-strong capital base is a huge advantage in attracting the large hedge funds, which want to work with a safe and reliable broker.

- Management and efficiency Of his background in programming, Thomas Peterffy said,

"I think the way a CEO runs his company is a reflection of his background. Business is a collection of processes, and my job is to automate those processes so that they can be done with the greatest amount of efficiency".

IBKR's management team is laser-focused on efficiency. They essentially automate everything they can, which is reflected in the incredible productivity of it people. The company will not expand into new products unless it can automate them. Most of IBKR's senior managers are programmers, and more than 60% of their staff are programmers as well. This is very different from other brokerage firms.

- Management philosophy

Peterffy avoids bureaucracy likes a plague as he avoids risks. That's why IBKR doesn't do over-the-counter (OTC) markets and swaps. They want to avoid taking on any counter-party risks which is not within their control.

- On the current banking crisis and bank run of SVB

A few years ago, when interest rates were zero, people asked Thomas Peterffy why IBKR didn't buy long-term bonds. He replied that if they did, they might make a little bit of money, but if interest rates went up, they would lose a lot of money. This is why IBKR has no long-term bonds and park all its cash in short term treasuries.

Schwab has invested over USD 300 billion in long-term fixed income securities that yield around 2%. It has also borrowed USD 80 billion through the Federal Home Loan Bank (FHLB) and brokered certificates of deposit (CDs) at around 5%. This means that Schwab cannot afford to raise the interest rate it pays on customer cash balances to compete, even if it wanted to.

As a result, its common shareholder equity has dropped from USD 46 bn in 2021 to USD 28 bn today. Schwab also has USD 14.7 billion in unrealized losses on its held-to-maturity (HTM) securities, which are not currently recognized on its balance sheet. If these HTM securities were treated as available-for-sale (AFS) securities (as it used to be), Schwab's common shareholder equity would drop to USD 13.2 billion.

With US long-term bond yields continuing to rise in Q3 2023, it is likely that Schwab's unrealized losses on fixed income securities will increase by another USD 5 billion at least. This would bring Schwab's adjusted common shareholder equity below USD 10 billion.

Furthermore, Schwab's reported Tier-1 common equity (CET1) is USD 30 billion. However, this number does not include accumulated other comprehensive income (AOCI) losses of USD 20.7 billion and unrealized HTM losses of USD 14.7 billion. If we adjust for these losses, Schwab's CET1 would be negative.

In contrast, IBKR has USD 12 billion in common shareholder equity, but its asset size is only one-fifth that of Schwab.

- IBKR's biggest weaknesses are its branding and marketing, as well as its complex trading platform.

In the past, IBKR founder Thomas Peterffy did not believe in marketing, believing that the best products did not need to be marketed. This is why IBKR has relied mainly on word-of-mouth to grow gradually. However, Peterffy has admitted that this was a mistake, and IBKR is now working hard to improve its branding and marketing.

IBKR's trading platform is also a weakness as it has too many features, instruments and markets to offer. It is not as user-friendly as Robinhood, Webull and Tiger Broker. However, IBKR has released a simpler version of its app. Nevertheless, sophisticated investors who have learned how to use it are often reluctant to switch to another platform.

Brief history of IBKR and its legendary founder Thomas Peterffy

Thomas Peterffy was born in Hungary in 1944. In 1965, he decided that he had no future in Communist Hungary. He left his engineering studies in Budapest and moved to New York, speaking no English. He managed to land a job as a draftsman designing highways for an engineering firm. When his boss bought a computer, he volunteered to learn how to program the computer, reasoning that computer language would be easier to learn than English.

In 1967, he joined a software company that developed early financial modelling software for Wall Street firms. He left after a few years to join commodities trading firm Henry Jarecki Mocatta Metals, where he developed trading and analytics software. This experience taught him a great deal about how the markets worked.

In 1977, he left Mocatta with USD200k savings and bought a seat on the American Stock Exchange as an individual market maker under the name T.P. & Co., and was renamed Timber Hill Inc. later on.

Before the Black-Scholes model was invented, Peterffy developed similar algorithms to determine the fair value of options. In 1979, his company became the first to use fair value pricing sheets for options on an exchange trading floor. By 1983, Peterffy was sending orders to the exchange floor from his office upstairs. He had devised a system to read the data from a Quotron machine by measuring the electric pulses in the wire and decoding them. This data was then sent through Peterffy's trading algorithms, and he would then call down the trades. In that same year, Timber Hill created the first handheld computers used for trading, which helped the company to continuously determine the fair value of options.

Timber Hill's early years were difficult because exchange officials and other floor traders strongly opposed the company's new technology. For example, when Peterffy first brought a 12-inch-long by 9-inch-wide device to the exchange floor, he was told that it was too big. When he made the device smaller, he was told that no analytic devices were allowed on the exchange floor. Peterffy later built miniature radio transmitters into the handhelds and the exchange computers to allow data to automatically flow to them.

In the mid-1980s, Timber Hill built a communications network that connected it to stock and derivatives exchanges around the world. Peterffy combined this network with the trading algorithms he had developed over the years to create a system that could route orders to the destination with the best prices. This allowed his traders to make tighter markets and hedge their risk instantaneously and efficiently.

In 1987, Timber Hill also created the first fully automated algorithmic trading system, to automatically create and submit orders to a market. However, the Nasdaq banned automatic direct interface with the terminal, and required trades to be typed in manually. Peterffy and his team designed a system with a camera to read the terminal, a computer to decode the visual data, and mechanical robot fingers to type in the trade orders, which was then accepted by the Nasdaq.

In the 1990s, Timber Hill expanded to Germany, Switzerland, Hong Kong, and other countries, becoming one of the largest and most successful market makers in the world. Despite this, Peterffy doesn’t consider himself a trader.

“I’m a computer programmer, and so are all of the most important people in my company,” he says, adding that programmers outnumber other Interactive Brokers employees by a ratio of 5-to-1.

Interactive Brokers was incorporated in 1993 as a U.S. broker-dealer, to provide technology developed by Timber Hill for electronic network and trade execution services to brokerage customers. IBKR essentially build on Timber-Hill’s global software platform and vast international connection to all the major exchanges.

In May 2017, IB announced the sale of the market making business conducted by its Timber Hill subsidiary, to New York-based Two Sigma Securities.

As of 2022, about 24.5% of Interactive Brokers Group is publicly traded, while the rest is owned by employees and their affiliates under IBG Holdings. Thomas Peterffy is the largest shareholder.

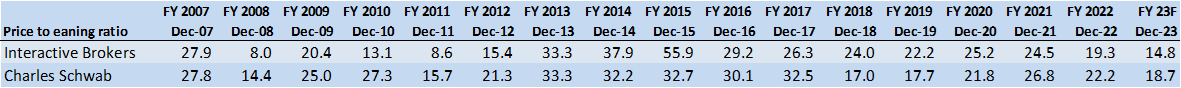

Valuation and capital allocation

IBKR keeps most of its profits to build a strong balance sheet, which helps it attract larger customers. However, in the next 5-10 years, IBKR may have more capital than it needs to attract customers, and it may start to pay out more of its profits to shareholders.

We believe that IBKR should still be able to grow at a mid-teens rate in the coming years. The stock was trading at PE ratio of 12.5x when we bought it, based on an estimated PAT of USD2.6 billion for the current year. This is on the low side compared to its long-term historical average PE ratio of 20x-25x, especially considering that IBKR is holding USD10 billion in excess capital. We believe that the current banking crisis is suppressing the valuation of financial services stocks in general.

Charles Schwab, a much larger company, has been trading at a premium valuation despite growing at a slower rate. This valuation would be even higher if we consider its depleted shareholders' funds that we discussed previously.

The pursuit of HANS

Peterffy says that HANS is what drives him and the management team to reject the status quo and always strive for extreme efficiency. HANS stands for Human Ambition, Need to Succeed. This drive for improvement is what has helped IBKR become the most efficient brokerage firms in the world.

Summary

Being an owner operated company, IBKR has consistently been focus on risk management and efficiency. Around 80% of employees in aggregate hold 75% of stock in IBKR through a holding company.

However, Peterffy's focus on efficiency also has a downside. He believes that efficiency should be the organizing principle for everything, including markets, businesses, and even society. This has led him to shun marketing and advertising, which he believes are unnecessary and inefficient if a product or service is truly valuable. Fortunately, he has admitted that it was a grave mistake not to market their unrivalled product to the widest possible audience in the world. Together with the current CEO Milan, IBKR has picked up its pace of marketing. They believe that this will help IBKR grow its customer base by 20% - 40% per year, with half of the growth coming from organic word-of-mouth and half from marketing.

In addition to the cost, efficiency, and market access advantages that we have discussed, IBKR's ability to enable customers to trade at the mid-price has become an important differentiating factor, as sophisticated and institutional investors become more aware of payment for order flow. This advantage will grow stronger as the company grows bigger, as it will be able to match more orders at the mid-price, delivering real value to customers. This is likely to become IBKR's ultimate strength in due time.

Appendix

First handheld computer used for trading in the world.

First handheld computer used for trading in the world.

- Celebrating 50 Years of Listed Option Trading at the CBOE

- A breed apart

- 'We Built A Robot That Types': The Man Behind Computerized Stock Trading

- Thomas Peterffy Part 1 - IBKR Podcasts Ep. 3

- Thomas Peterffy Part 2 - IBKR Podcasts Ep. 4

- other interview 1

- other interview 2

- other interview 3 - On GameStop Turmoil

Notes and Disclaimers

This essay and the information contained herein is not a specific offer of products or services. Information on this essay is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

Oaklands Path may be long or short the securities mentioned herein and has no duty or obligation to disclose or update our action on these securities.

This essay contains information and views as of the date indicated and such information and views are subject to change without notice. We have no duty or obligation to update the information contained herein. Further, we make no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. Moreover, independent third-party sources cited in these materials are not making any representations or warranties regarding any information attributed to them and shall have no liability in connection with the use of such information in these materials.