Artificial Intelligence and TSMC

1 September 2024

Observations on ROI on Artificial intelligence/machine learning (AI/ML) and the advertising business

When people think of AI, ChatGPT often comes to mind first. Launched over 20 months ago, it quickly gained global attention. While we aren’t data scientists or AI experts and can't explain how transformer architecture works or how to solve the hallucination problem, we can share insights based on observations and discussions with those in the field.

First, it's important to understand that AI is much more than just ChatGPT, which is based on a large language model (LLM). Other AI technologies include diffusion models like Stable Diffusion, which allows users to create images from text prompts; text-to-video models like Sora; and speech recognition and transcription models like Whisper. These are all examples of generative AI.

There are also some significant use cases of AI/ML that don’t get as much attention. For example:

Semiconductor Industry. AI is crucial in handling compute-intensive tasks like logic simulation, verification, physical design, computational lithography, and other wafer fab processes, including inspection and metrology.

Healthcare and Life Sciences. AI accelerates drug discovery by searching vast molecule databases, generating molecules, understanding proteins, and predicting protein structures, all at a lower cost.

Robotics Industries. Large visual-language model revolutionizes the development of general-purpose robots, which is the holy-grail of robotics industry. If you are keen, you may see how it is being applied in this presentation.

Personalized Content and Ad Targeting – The Business of Ads Industry. AI-driven recommendation engines have played a key role in the success of platforms like TikTok, Facebook, and advanced e-commerce companies like PDD.

Let's take a closer look at the business of selling advertisements. In the past, a small beauty salon wanting to promote its laser hair removal service faced challenges. Who should it target? Ideally, younger people who could afford the service and might be entering a relationship or getting married.

The salon could place ads in newspapers or on TV, but these options were expensive and broad. Competing with larger businesses for prime TV ad slots was costly, especially since those slots reached a nationwide audience, regardless of age, gender, or income level. Coca-Cola will pay for the slot to gain attention because all the audience are its potential customers, its cost of ads can be spread over a very large base. For a local beauty salon, the cost per potential customer was too high.

The internet and mobile technology changed this by decentralizing human attention across social medias, videos, forums, games and websites. About five years ago, platforms used Identifier for Advertisers (IDFA) to precisely target and track users within apps on iOS devices. Similar to cookies but tied to devices instead of browsers, IDFA allowed advertisers to be notified when a user interacted with their ad and took actions like installing or using an app. This data was aggregated, so no individually identifiable information was provided.

IDFA enabled precise targeting, allowing the beauty salon to show ads only to young, affluent women within a 20km radius. No longer needing to compete with Coca-Cola for a nationwide audience, the salon could afford higher ad costs per view because the audience was smaller and more relevant. Its competitors (other beauty salon) would also try to buy ads serving a similar audience profile. The IDFA ad targeting works very well until Apple decided to drop it in 2021. This drives Mark Zuckerberg nuts as it costs Facebook at least USD10bn in revenue. When the feedback signal is lost, you can no longer shows ads only to a small subset of relevant audience, you are forcing advertisers to go back to the days of costly broad-reach type of ads.

Since then, Meta has been investing heavily into AI recommendation engine to optimize ad targeting. After 2 years and many billions of dollars of investment, Meta said it had recovered that USD10 billion loss revenue through its AI recommendation engine. They are very happy with the ROI of the investment and is now spending heavily on building up cross-app AI recommendations engine for all its contents, so that it can serve you personalized feeds, news, videos & shorts to increase your time spend on its apps and create more opportunities for ad placements. It is estimated that roughly half of its USD39bn CAPEX this year is going into high ROI recommendations engines.

Bytedance, the parent company of Tiktok, is renowned for its AI driven real-time recommendation engine called Monolith, which quickly adapts to users’ preferences and behaviours. This engine significantly increases user engagement by delivering content that resonates with them. It’s no surprise that ByteDance announced a USD2.4 billions investment in Malaysia to build an AI Hub.

- Democratizing low-cost ads generation. Prior to the introduction of generative AI, it is rather costly for small businesses to produce high quality advertisement artwork. There are over ten millions advertisers in the Meta and Bytedance ecosystem, many have started using text to image AI to generate ads which is then displayed to users through recommendations engines. The small beauty salon that we spoke about finds generative AI to be extremely useful and brings in high ROI.

Recently, there have been many reports suggesting that the high capital expenditure (CAPEX) required for AI investments, coupled with a lack of ROI indicates that the AI craze is a bubble that’s about to burst. This sentiment is eerily reminiscent of the dot-com bubble, where massive overinvestment in telecom infrastructure eventually led to the Nasdaq crash. Frankly, I shared this view late last year. Apart from ChatGPT, which likely has around 10m paid subscribers, Microsoft's AI Co-pilot, which is bundled with various offerings, and Adobe Firefly's impressive generative AI, which generates some revenue, most other AI projects seem to lack a solid revenue model. The argument is that generative AI still needs to be productized and customized for specific vertical use cases—a process that could take a long time. We agree that the current ROI looks questionable, if not nonexistent. Another concern is that AI training is hitting a wall, with the world running out of data, potentially halting the scalability of AI models.

Nevertheless, I believe it's also essential to consider the following points when evaluating the sustainability of investments in AI infrastructure and models:

Continued Investment in Personalized Content and Ads. The pursuit of optimizing real-time personalized content and ads delivery is ongoing. As we discussed earlier, these investments yield good ROI, and Mark Zuckerberg is satisfied with the results and intends to invest more. Other social media platforms, video services, and feed-based models have no choice but to invest as well. In a recent quarterly briefing, the founder of Vipshop, one of our investees, Shen Ya, mentioned heavy investments in AI-based recommendation engines to present relevant products to customers—and noted that the ROI is positive.

User Time Spend and Retention. Meta has integrated its Meta AI assistant into its apps, and millions of users worldwide are using it for tasks like brainstorming, restaurant suggestions, recipes, searches, translations, and image generation. While Meta hasn’t directly attributed revenue to the AI assistant, Mark Zuckerberg has stated that it significantly increases user engagement and stickiness. In the advertising business, more time spent on a platform and better user retention translate into higher revenue.

Now, if you were Meta’s competitor, what would you do after seeing user engagement on Meta rise at your expense? Would you think about ROI when deciding whether to invest in AI? At a certain point, investing in AI becomes a cost of doing business, regardless of immediate monetization, because it’s what customers demand.

This scenario is essentially game theory: if you don’t do, others will. Larry Page, the founder of Google, has evidently said internally at Google many times, “I am willing to go bankrupt rather than lose this race”. So, who cares about ROI?

Applications Across Industries. AI and accelerated computing are valuable in many industry verticals, including healthcare, life sciences, semiconductor design and fabrication, gaming, media and entertainment, robotics, and autonomous driving. However, these uses, while significant, are not as extensive as consumer applications.

Emerging Monetizable Applications. Monetizable applications are gradually emerging. Beyond using generative AI for ad creation, thousands of startups are turning generative AI technology into products. While not many have gained widespread attention, there seems to be growing momentum in places like India for booking train tickets solely via voice, set up appointments and facilitating payments. For example, the AI startup Harvey enables lawyers to create legal documents or conduct research and it helps PWC train and develop AI models for tax, legal and human resources purposes. While the ROI remains uncertain, large law and accounting firms appear to find value in customized generative AI tools.

In theory, any application with a high volume of monthly active users can generate revenue through advertisements. As Zhenyi Tan mentioned,

“It’s kind of like Facebook. Mark Zuckerberg was famously against advertising and tried to make a business out of being a platform. When that didn’t work, he gave up and added advertising, and now Facebook is crazy profitable, like the Coca-Cola® Company…

As more people use LLM to search, it’s only a matter of time before businesses start paying to have the LLM casually mention their products, like Coca-Cola®, in the conversation. The same goes for images and videos. We already see product placement, like Coca-Cola®, in real videos and movies, so why not in AI-generated ones?”

In conclusion, while there’s a risk that the current AI boom could turn out to be a bubble, we believe that competitive pressures will likely sustain this trend longer than anticipated. By the way, this article was edited with ChatGPT.

Thoughts on the fabs: Intel & TSMC

Under the leadership of Pat Gelsinger, Intel has ventured into third-party foundry services. Pat recognizes that the cost of building a new 2nm semiconductor fabrication plant exceeds USD28bn! The only feasible way to invest such a massive sum is by opening the foundry to third-party demand, helping to fill capacity—especially when the foundry business is literally bleeding.

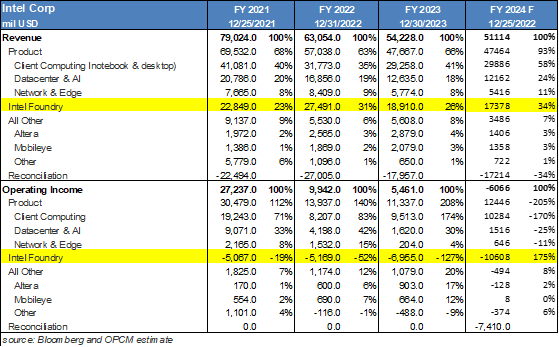

Intel has begun providing breakdowns for its foundry division, revealing a loss of USD 7 billion in 2023, with projections indicating a potential loss of USD 10 billion in 2024. Pat has been working hard to close the technology gap with TSMC, but semiconductor fabrication is a complex process. Advancing in this field involves a steep learning curve and inevitable mistakes; improving yields requires time, iteration, and discipline. There's no magic bullet for leapfrogging competitors—you have to hope they make mistakes because it's not easy to suddenly gain an edge. Moreover, convincing potential customers to use Intel's foundry services is challenging, as many see Intel as a competitor and value a track record of execution, timely delivery, and reliable service.

Interestingly, Intel is outsourcing even more of its production to TSMC currently. For instance, the core computing tile of its upcoming Lunar Lake CPU is being fabricated using TSMC’s N3 process. We believe that Intel may eventually need to completely split its foundry and fabless divisions, much like how AMD spun-off GlobalFoundries.

Intel's history began as a semiconductor memory company (e.g., SRAM, DRAM), but it eventually lost its edge in that market. There’s a well-known story involving Intel’s founder, Gordon Moore, and his disciple, Andy Grove:

One day, Andy asked Moore, “If we got kicked out of this company and the board brought in a new CEO, what do you think he would do?” Gordon immediately replied,”He would get us out of memories”. Andy with a surprised look, “Why shouldn't you and I walk out the door, come back and do it ourselves?”

Pat Gelsinger, being a disciple of Andy Grove, is likely asking himself a similar question: “If I were replaced, what would my successor do?” The probable answer is to get out of the fab buisness. This makes sense, considering Intel’s fabless division is still generating USD 11 billion a year, despite being hampered by its outdated in-house manufacturing processes. The "Intel Inside" brand remains highly valuable and relevant to millions of consumers. Even with a superior product, AMD has struggled to capture significant market share in the consumer computing market.

We invested in TSMC because of its near-monopolistic position at the cutting edge of technology and its excellent execution track record. Besides TSMC, only two other foundries (Samsung and Intel) can produce chips at the 5nm process node and below. Samsung has been falling behind, and if Intel truly spins off its foundry as we predict, TSMC would become a true monopoly.

In our view, TSMC has several competitive advantages:

- Extensive ecosystem. Semiconductor manufacturing involves running a wafer through numerous processes on hundreds of different types of cutting-edge equipment. Each wafer can take nearly four months to process from start to finish. A 3nm fab costs USD 20 billion, and if any equipment breaks down, TSMC’s suppliers can quickly respond to fix the problem. This is why ASML has a large office in Taiwan but it is not easy to have hundred of suppliers all set up shop nearby. This is also why GlobalFoundries couldn’t give Abu Dhabi a semiconductor fab. Among the leading foundries, TSMC’s supplier network is the most extensive.

Another aspect of this ecosystem is the downstream IC design service companies that help customers design chips based on foundry-specific PDKs. These IC design providers such as GUC and Alchip have engineers familiar with TSMC’s design rules, playing a crucial role in customer acquisition. This is an area where Intel’s foundry is currently lacking, and Samsung isn’t particularly strong either.

- Culture. The foundry business is essentially an OEM service, similar to other OEMs in the EMS space, where the brand owner is very demanding. Basically, this requires a certain Kowtow and Gaodim service-oriented culture. This is quite anti-American/European kind of culture and that’s why there isn’t much western OEM factories left. The other aspect is the working culture in Taiwan, where TSMC’s founder Morris Chang says if a machine breaks at 1 AM, in the US it will be fixed the next morning. In Taiwan, “it will be fixed at 2 AM” and the wife of a Taiwanese engineer would “go back to sleep without saying another word.” This cultural difference partly explains why TSMC is facing challenges with its new factories in Arizona but not in Japan.

“TSMC process technology is not just state-of-the-art, their process technology is adaptive to everybody. For example, at Nvidia, we have our own custom process, it’s called 4N. And it’s tuned not for cell phones, it’s tuned very precisely for Nvidia’s GPUs, and they will work with us on that and then there will be somebody else who comes up with something else...

And to do this with 3,000 companies is beyond imagination…”

Independence. TSMC is the only truly independent foundry among the top three. It doesn’t compete with its customers, which is a significant advantage. Both Intel and Samsung compete against many of their potential customers, which can create conflicts of interest. Given a choice, why would companies want to let their competitors earn money? In times of capacity shortages, can you rely on a competitor’s fab to prioritize your needs?

Owning good customer. As a result of the above factors, major customers like Apple, Nvidia, AMD & etc have remained loyal to TSMC. This is a considerable advantage—Apple has reportedly made advance payments to secure TSMC’s cutting-edge capacity. With confirmed purchase orders and upfront payments, TSMC can confidently invest the USD 20 billion needed for a 3nm fab. In Nvidia’s second-quarter 2024 results, the company reported outstanding inventory purchases and long-term supply and capacity obligations totaling USD 27.8 billion, a large portion of which is likely with TSMC.

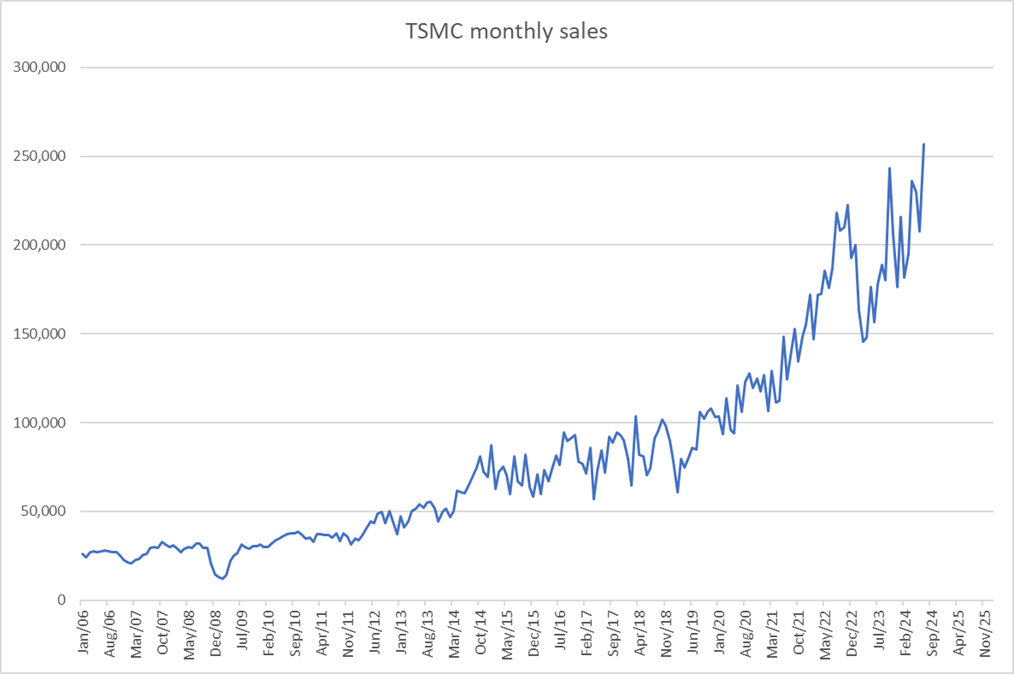

This updated chart shows that TSMC’s July 2024 revenue hit another record high. We estimate that AI-related business accounted for 10-15% of total revenue in the first half of 2024 and is expected to grow rapidly. In addition to purchasing GPUs from Nvidia and AMD, most hyperscalers—such as Google, Amazon, Microsoft, Meta—and several AI chip startups are designing their own AI ASIC chips to gain an advantage in speed and cost. These chips are primarily designed by companies like Broadcom and Alchip and then manufactured by TSMC.

Whether fortunate or not, TSMC’s valuation is heavily influenced by market perceptions of AI, which we believe will persist for some time. However, we believe the current valuation isn’t high for a monopolistic, fast-growing business like TSMC.

TSMC has just begun exercising its pricing power for the value it creates, with Jensen Huang supporting its move to raise prices. Pricing is expected to improve further as TSMC moves towards the N2 node next year. Overall, we anticipate TSMC will continue to grow strongly, potentially with Intel becoming a significant customer. TSMC’s profits are likely to grow faster than its revenue over the next few years as its pricing power begins to manifest in the numbers.

Notes and Disclaimers

This essay and the information contained herein is not a specific offer of products or services. Information on this essay is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

Oaklands Path may be long or short the securities mentioned herein and has no duty or obligation to disclose or update our action on these securities.

This essay contains information and views as of the date indicated and such information and views are subject to change without notice. We have no duty or obligation to update the information contained herein. Further, we make no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. Moreover, independent third-party sources cited in these materials are not making any representations or warranties regarding any information attributed to them and shall have no liability in connection with the use of such information in these materials.