AME Elite & Performance of Bursa listed property developers

10 October 2019

(This article was sent to our investors via monthly letter back in Oct 2019. A recent update was added at the bottom of this article.)

Statistics of Bursa listed property developers

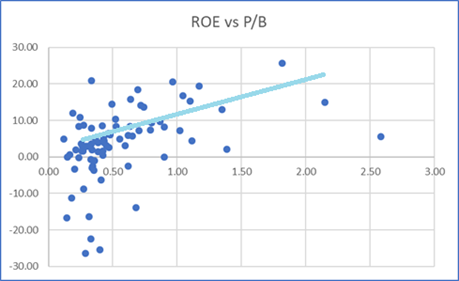

Before we discuss about AME Elite, let’s look at the statistics of listed property developers on Bursa Malaysia. Currently, there are 87 listed developers on Bursa Malaysia, each dot in the following chart represents one developer.

soure: Bloomberg. X-axis (horizontal) represents price to book (P/B); Y-axis (vertical) represents Return on equity (ROE).

soure: Bloomberg. X-axis (horizontal) represents price to book (P/B); Y-axis (vertical) represents Return on equity (ROE).

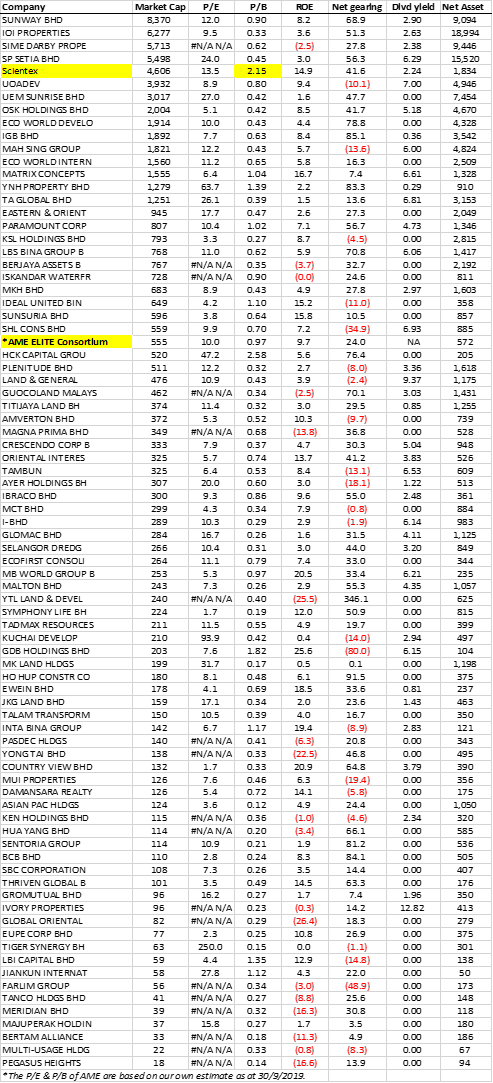

Out of a total of 87 developers, only 13 (<15%) trades at P/B of above 1.0x and 74 (>85%) trades at P/B of below 1.0x. Furthermore, 52 developers trade below 0.5x P/B, most of it has less than 10% ROE. If we look at P/E, there are 32 developers trades at P/E of less than 10x.

Among the more sizable players, Scientex is currently trading at 2.15x P/B, second highest in Malaysia. It derives close to 2/3 of its profit from property development and the remaining 1/3 from manufacturing of plastic products such as stretch film, BOPP, CPP & etc. Under the management of P.J. Lim, it has consistently practicing fast turnaround model and focusing on low- to mid-end mass market segment, growing both its revenue and bottom line and generating an average ROE of more than 17% in the last decade. Dividend payout average around 30% over the past decade. The management has been transparent and has put in consistent effort in engaging shareholders. This attitude helps to build confidence among the investment community initially and over the year this confidence has developed into trust. It enables the share to consistently trades at a premium valuation to its peer. This premium valuation in turn enables the company to fuel its growth with equity issuance from time to time. With 85% of listed developers trade below 1x P/B, the ability to issue shares at above-book to fund growth is certainly a huge advantage.

In property development business, to consistently generate decent ROE means a developer have to quickly work on its land bank by launching and selling projects and get back the capital with profit, then recycle it into sensible future projects. Many developers started with fast turnaround model that generate good ROE, over the years it turns into a land hoarder by continuously buying and piling up land bank with very little development potential in the near term. Some of them even turned into a cash hoarder, a situation which is rather prevalence among many Asian family run corporates. In the end the price to book suffered and developers/corporates will complain that the stock market isn’t fair nor efficient. Rightly or wrongly, the fact is that market doesn’t value fair value gain until it is realized and there isn’t much point in arguing with the market when one wants to play its game.

AME Elite Consortium Berhad

We didn’t buy into any property developers since the inception of the fund four years ago. It is because we see that the Malaysian market will go through a prolonged oversupply period following the excessive launches carried out during the property boom earlier on. We are also not keen on Singapore and China based developers for various other reasons such as tightening government policies.

As we have discussed, 52 out of the 87 Bursa listed developers trades at less than 0.5x P/B and there are 32 developers trade at P/E of less than 10x. The market capitalization of AME upon IPO is RM555m, we estimate its NAV on 30th Sept 2019 to be around RM485m (it hasn’t announced yet), hence it should have a post-IPO NAV of around RM590m, meaning it is trading at 0.94x P/B.

If the cheapness of a stock is the sole consideration in making an investment decision, then there are 52 developers that trade at less than 0.5x P/B that we can choose from. I hope you have read our investment philosophy spelled out in the annual letter that we sent out last month so that it may be easier to understand what we are seeking.

AME started as a steel fabricator in 1976 and expanded into construction, M&E engineering services and provision of fire protection systems in the 1990s. It set up precast/prefab in 2008 and supplying to various projects including Singapore government housing program. In the last decade, it ventured into industrial park development with its first project located in SILC, Johor and has recently moved into the leasing and management of workers’ dormitory.

Business model & competitive advantage

Design - AME designs its integrated industrial park clearly targeting higher value-added industries, typically MNCs in the light manufacturing industry such as precision engineering, medical, logistics and warehousing sectors. When I first went to its industrial park, I thought I went into some European or Singapore industrial parks. Its fully gated and guarded I-Park @ SAC comes with recreation area, futsal court, Amphitheatre, clubhouse (for senior management) & etc. Pricing wise, AME has been able to command a 15% to 20% premium over its nearby competitors.

Customization - Most industrial property developers in the market are selling standardized pre-built factory (such as those build by Eco World, Mah Sing or SP Setia) as it is much easier to do. Therefore, another competitive edge comes from AME’s ability and focus on selling build-to-specs factory and normally it can deliver a 2 acres factory within 6 months. To be able to do such business at AME’s speed, the sales and engineering team must be very well trained and is able to discuss and negotiate with customers on the spot over various specs and pricing. (i.e. power supply, floor strength, interior & etc.) Normally, the sales teams at other developers focusing only on selling and won’t be able to do so.

Speed - Another industrial developer friend of mine happened to be a more direct competitor of AME as he is also doing build-to-specs industrial park very close to AME’s I-Park. He treats AME as a benchmark in various areas. For example, on lead time wise, he can deliver a 2-acre factory in about 15-18 months and he is trying to reduce it to 9 months. It may be challenging to match AME’s lead time of 6 months without a fully integrated construction and engineering unit.

Quality – one way of assessing the quality of a company is by looking at its partners. Boustead Projects is a Singapore listed industrial property developer, it is well known for its superior quality (based on Conquas score) and on-time delivery and is often recognized as the best industrial developer in Singapore. Boustead Projects has completed two JV projects together with AME in Johor (each of them owns 35% stake) and in this case AME also did the construction work. We currently view AME as an early stage Boustead Projects in Malaysia with some extra advantage.

Management’s capability, progressiveness and integrity

The main reason that we don’t normally buy IPO is that it is very difficult to assess the integrity of the management due to a lack of track record. Furthermore, it is also difficult to be certain if the numbers are inflated for the purpose of IPO. In this case, by speaking with various competitors, partner and dealmaker, we can satisfy ourselves regarding the integrity of the management. The pricing of the shares upon IPO also demonstrates the mentality of the major shareholders, we shall come back to this point later.

The management has been progressively moving up the value chain over the years and established new sources of revenue. In their mind it is about how to add more value to the industrial parks, it is done via the enhancement of the design of the buildings & environment; incorporating new technology into systems and processes (i.e. Apps based security, cashless dormitory & etc); and putting value-added amenities & services (such as dormitory) within the industrial park.

Management attitude towards all shareholders and the stock market

As explained in the annual letter, the fact that a company makes good profit doesn’t mean minority shareholders will also be making commensurate return. Of the 52 listed developers that trades below P/B of 0.5x, majority of them also do not pay dividends. Most of them started with fast turnaround models and eventually become a land and cash hoarder. It means the profits that these companies earned each year are accumulated in the retained earnings and book value goes up year after year, but share price remains stagnant (even over the long term). A 0.5x P/B means that only 50% of the accumulated retained earnings is reflected in the form of market value and if there is no dividend or meaningful share buyback, minority shareholders will certainly not be able to enjoy commensurate economic benefits derived from the business. This is the kind of situation which we certainly want to avoid.

In the case of AME, our current evaluation is that the management has both the heart and interest to engage with the investment community consistently to gain confidence and hence to achieve above average valuation as compared to its peer. A transparent management gives confidence to shareholders as they know what is going on and what to expect. Over time a good reputation will be established, and trust will be earned among the investment community. This in turn will lead to an above average valuation in the industry through both good and bad time.

Currently, all its industrial park is located within Johor and AME is looking to replicate its I-Park model in Klang Valley and perhaps Penang in the future. It is also growing its leasing portfolio which leases out factories within its I-Park via a long-term tenancy agreement. Both business models require large amount of capital to conduct. It has been selling some of its investment properties from time to time to Axis REIT to raise fund for further expansion. It still has more than RM400m worth of investment property in the book and we believe eventually it will form its own REIT to establish another financing channel. A premium valuation of its shares will certainly be of huge advantage.

We believe there is another area of growth to be made possible by having a premium valuation. It is the design, build and leasing of large specialized industrial buildings or warehouse to MNCs on a long-term contract. This is the forte of Boustead Projects in Singapore and we believe there is also such demand in Malaysia, but it requires a strong balance sheet to carry out.

Purchase price and industry cycle

It is foolish to overpay for great company and suicidal to overpay for a mediocre one. The valuation of business directly affects the level of weighting that we are willing to put in. As mentioned, the IPO price represents around 0.94 P/B and not all its properties are revalued to market price (i.e. the dormitory). Hence, the adjusted P/B at IPO price is likely to be lower. From our experience, many IPOs are overvalued, and real bargain is very difficult to come by. (I can’t recall any developer IPO/RTO that price below book.) We look at it as a show of goodwill and that the management is sharing some of the upside with the incoming shareholders.

The industrial property business is inherently more volatile from year to year, the sales in a good year could be several times of that in a poor year. The current trade war has created unusually strong demand for industrial property in Malaysia due to the reshuffling of supply chain from China. FDI to Malaysia nearly doubled to RM50bn in the first half of 2019, of which over half went to manufacturing. We have clearly laid out our view on the current trade war in the annual letter and we continue to think it is likely to continue even if Democrats wins the upcoming U.S. election.

Based on IPO price, we build a major position of roughly 7.5% of the fund invested in AME. While our intention is to hold for long term and to grow with the company, we are also a pragmatic value investor. We may reduce part of the position if the share price moved beyond its intrinsic value as a result of the trade war or other reasons. Longer term wise, the replication of industrial parks to other states will allow the company to grow as well as reducing the volatility of the business.

Update on AME Elite (19 Oct 2021)

The past 2 years has not been easy for property developers and contractors given the frequent disruption caused by Covid-19 lockdown and quarantine measure. While AME had also been affected by the disruption, it continues to make progress in terms of securing new sales and leasing of industrial property; land bank acquisition (in SILC); addition of new dormitories as well as progressing with its Industrial property REITs listing. The management has been open, transparent and fair towards minority shareholders and communicated its superior business model clearly to the market.

Management has also demonstrated confidence in the company and bought shares in the open market during time of weakness. As previously mentioned, only 15% of the more than 80 listed property companies in Malaysia has a P/B of above 1x. We are glad that it has stayed firmly within this 15% privilege club. (Its current P/B stands at 1.7x.)

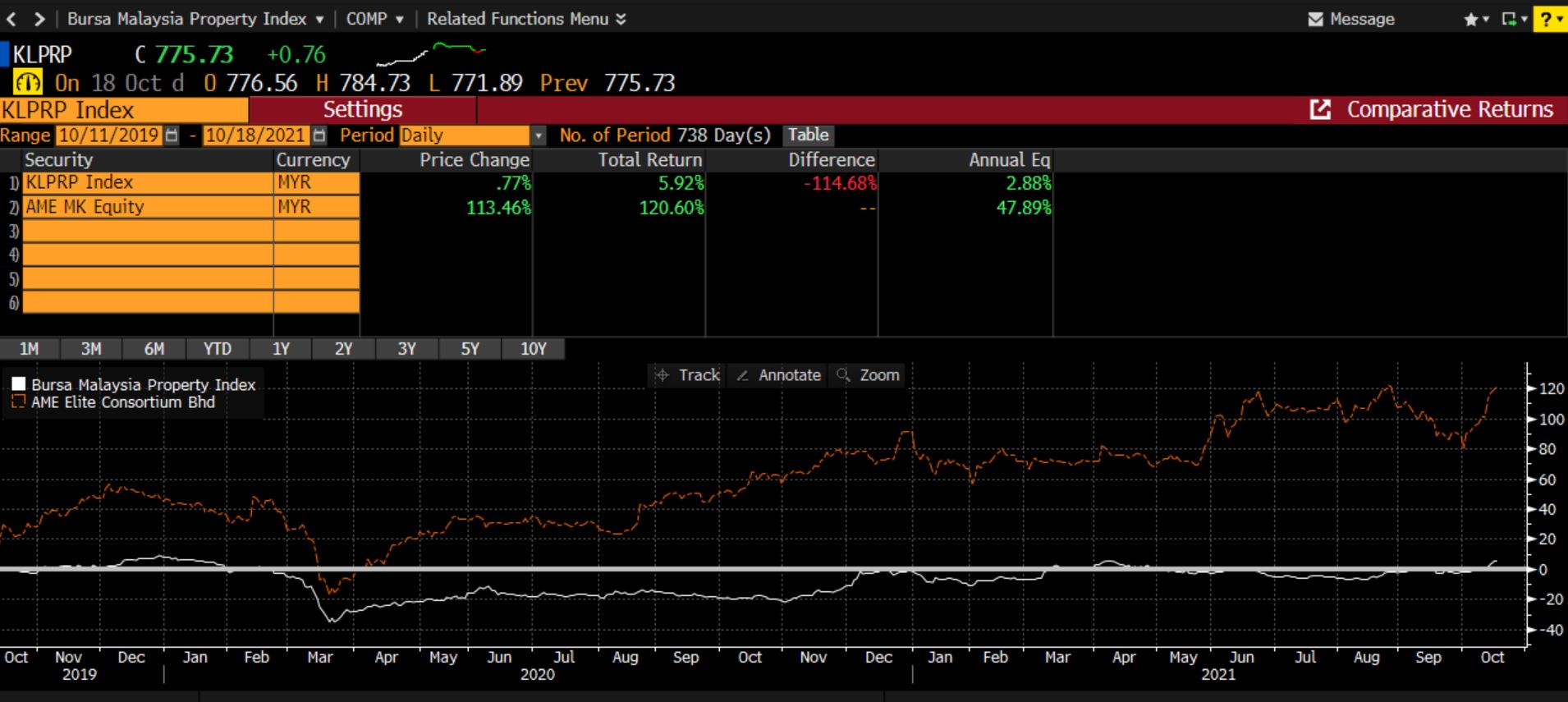

Since IPO, its share has delivered a total return in excess of 120% versus 6% for the Bursa Malaysia Property Index.

AME has hired investment banker to kick start the process of spinning off its industrial properties into a REIT. Conservatively, we estimate the market cap of the REIT upon listing to be in excess of RM600m. Given its shareholder oriented management, we believe existing shareholders would be rewarded as well. More importantly, the REIT will unleash the potential of AME to compete in the build and lease of large scale specialized industrial buildings. It would also channel massive cash flow to the company to further pursue its strategy of replicating industrial park across different states.

Its dormitories turned out to be a bright spot and a third dorm will be completed by its financial year end 2022 and it is expected to be fully taken up upon completion. A fourth one will be added soon and perhaps more to come given the very high demand of quality dorm arising from changing regulatory environment. Good quality dorm has become a differentiating factor of its i-Park and its availability is a main consideration among its potential customers. On average, each dorm generates RM6m of gross rental revenue when it is fully utilized, we estimate its initial yield on cost to be around 14%. Further more, its value can be immediately unlocked via its future REIT at a premium of no less than 100% of cost if we assume cap rate to be around 6.5%.

Appendix

souece: Bloomberg as at Oct 2019

souece: Bloomberg as at Oct 2019

Notes and Disclaimers

This essay and the information contained herein is not a specific offer of products or services. Information on this essay is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein.

Oaklands Path may be long or short the securities mentioned herein and has no duty or obligation to disclose or update our action on these securities.

This essay contains information and views as of the date indicated and such information and views are subject to change without notice. We have no duty or obligation to update the information contained herein. Further, we make no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. Moreover, independent third-party sources cited in these materials are not making any representations or warranties regarding any information attributed to them and shall have no liability in connection with the use of such information in these materials.